Community benefit is a well-defined set of activities articulated by the Internal Revenue Service. The IRS has identified specific categories of community benefit with detailed definitions and specific accounting guidelines. The IRS requires that to be reported, a community benefit must respond to an identified community need and meet a community benefit objective, such as improving community health, increasing access to health services, enhancing public health, educating health professionals, or relieving the government burden to improve health.

Integral to the mission of Catholic and other not-for-profit health care organizations, community benefit is an extension of not-for-profit hospitals' historic mission to meet the needs of the time in their communities, especially the needs of vulnerable and disenfranchised members in their communities.

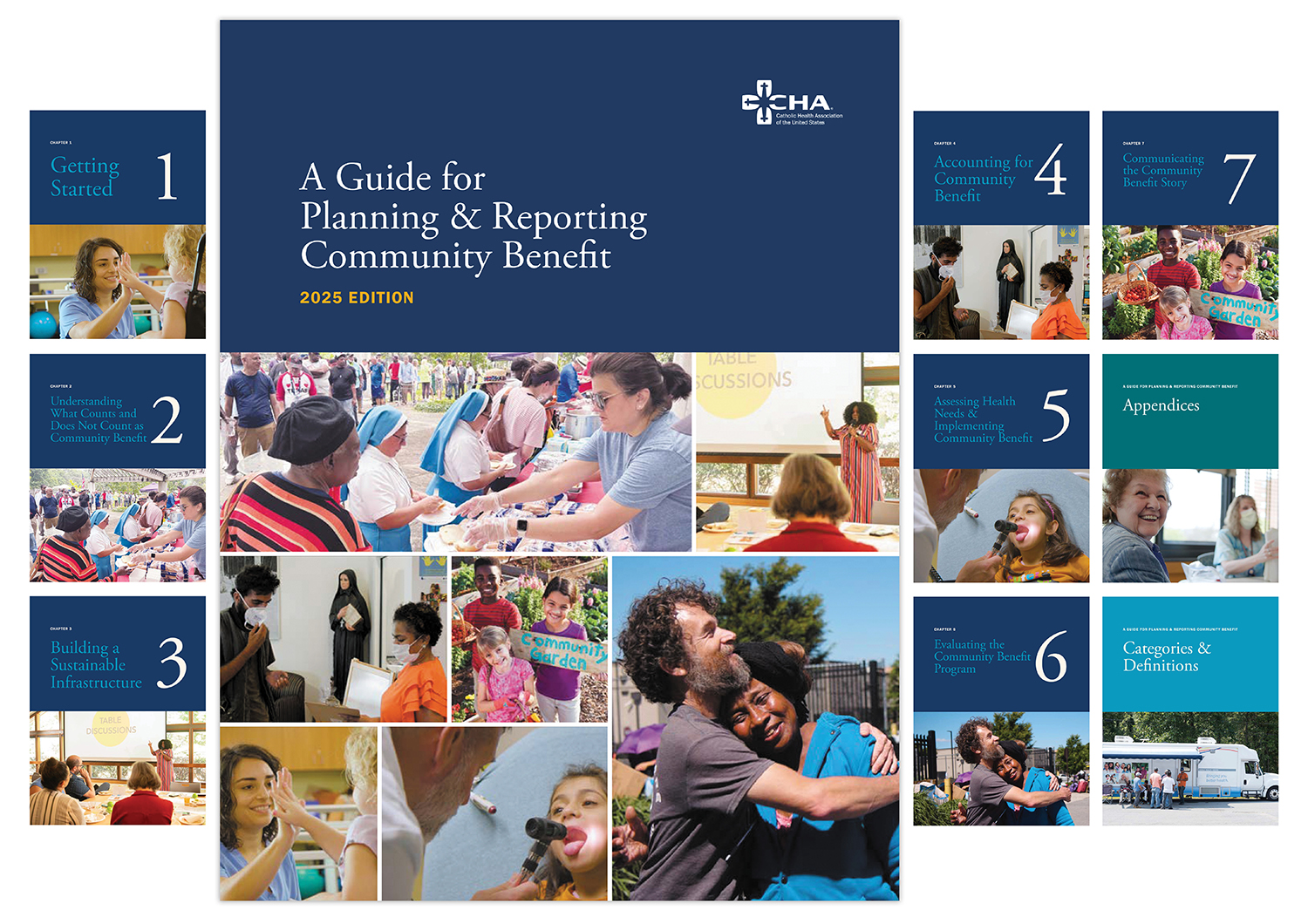

Community Benefit Guide

CHA's A Guide for Planning & Reporting Community Benefit provides a comprehensive framework for nonprofit health care organizations to develop and strengthen their strategic approach to assessing. planning, implementing and reporting community benefit.

Recommended Resources

More Resources

Community Health Needs Assessments & Implementation Strategies: A Summary of Federal Requirements and Recommended Practices for Nonprofit Hospitals

This booklet provides a concise overview of federal requirements for tax-exempt hospitals to conduct and adopt community health needs assessments (CHNAs) and implement strategies to address identified needs. It reflects the IRS's final rules, issued on December 31, 2014, in IRC Section 501(r)(3), and includes recommendations from community benefit and public health experts. This resource can be used to educate internal and external stakeholders who play a vital role in supporting the hospital’s assessment and community health improvement planning efforts, such as hospital trustees, finance and marketing staff, local health departments, and social service organizations.

Community Benefit Reporting Resources

This new set of resources was developed to help tax-exempt hospitals more accurately report their community benefit expenses. Designed for finance/tax staff, they can also help community benefit professionals better understand how they can support their finance/tax colleagues do this work.

.jpg?sfvrsn=b0c7b00b_1)

Investing in Community Health: A Toolkit for Hospitals

This toolkit is designed to help health care organizations look at their resources in a different light, expand their efforts to support their communities, and maximize their impact on community health by harnessing the power of their investment capital.

.jpg?sfvrsn=26caa26_1)

Healing the Multitudes - Catholic Health Care's Commitment to Community Health - A Resource for Boards

This resource, Healing the Multitudes – Catholic Health Care’s Commitment to Community Health: A Resource for Boards, explains why the Catholic health ministry is called to take a leadership role in addressing the social determinants of health and the board’s key role in making this work a strategic focus of their organization. This focus on addressing the root causes of poor health is not unique to Catholic health care. What is unique to Catholic health care is that our faith compels us to give special attention to our neighbors who are economically poor and to work for the common good. It is these values that drive us to lead the way in this work, even when the path forward is not clear.

Evaluating Your Community Benefit Impact

It is essential to evaluate community benefit programs in order to improve programs and ensure the effectiveness of actions taken to address significant health needs in the community.Community benefit program evaluation is important for compliance reasons as well. The Affordable Care Act added requirements for tax-exempt hospitals to assess the health needs of their communities every three years. The federal regulations implementing those requirements specify that hospitals need to include in their community health needs assessment (CHNA) reports an evaluation of the impact of actions taken to address the significant health needs from their immediately preceding CHNA report (Treas. Reg. § 1.501(r)-3). The intent of these requirements is to increase transparency and accountability around tax-exempt hospitals' obligation to improve community health.This CHA resource, developed in collaboration with Vizient and the Healthy Communities Institute, is designed to help community benefit leaders take a systematic approach to evaluating and improving their programs and to meet their legal requirements by applying the knowledge and experience of public health program evaluation to community benefit programs.While the resource is primarily geared to staff members who work in the area of community benefit, it can also be used by others who need to understand how to assess evaluation findings and use those findings in their work. Other groups that may find this information useful include trustees; executive leaders; strategy; population health; finance and communications staff; community partners; and program participants.Members Only: View and download a copy of Assessing and Addressing Community Health Needs. (Note: you must be logged in to access)

Assessing and Addressing Community Health Needs

Responding to the health needs of our communities, especially to the most vulnerable among us, is central to the mission of Catholic and other not-for-profit health care organizations. To do so, we need to have an understanding of community health needs and use a deliberate approach for addressing those needs.The importance of assessing community health needs and developing an implementation strategy to address selected needs was reinforced by the Patient Protection and Affordable Care Act (Affordable Care Act), enacted March 23, 2010. The law added new requirements on tax-exempt hospitals to conduct community health needs assessments and to adopt implementation strategies to meet the community health needs identified through the assessments.CHA, in collaboration with Vizient and the Healthy Communities Institute, developed this resource to help not-for-profit health care organizations strengthen their assessment and community benefit planning processes. Using CHA’s previous work, the experience of community benefit professionals and public health expertise, this resource offers practical advice on how hospitals can work with community and public health partners to assess community health needs and develop effective strategies for improving health in our communities.This resource was developed especially for the hospital staff responsible for conducting or overseeing community health needs assessments and planning community benefit programs.Others with an interest in community health may find this book useful as well. These could include staff within the organization such as administrators, clinicians and strategic planners, and community partners such as policy makers, consumer advocates, public officials and representatives of community groups.Members Only: View and download a copy of Assessing and Addressing Community Health Needs. (Note: you must be logged in to access)https://www.chausa.org/docs/default-source/member-only/focus-areas/community-benefit/community-benefit-assessing-and-addressing-full-book.pdf

CHA Articles

Season 6: Episode 6 - Collaborating to Address Food Insecurity in Rural Communities

Health Calls is available on the following podcast streaming platforms:

Season 5: Episode 9 - Data 101 for Community Benefit

When it comes to learning about and treating the communities we serve, data is the key. But with so much data out there, how do Catholic health providers begin to sort through it all and make sense of what they find?

Jaime Dircksen, Vice President of Community Health and Well-Being at Trinity Health, joins the show to discuss how she and her team utilize data to best serve Trinity Health's patient populations. She discusses key indicators they look for, how different customizable tools can help or harm the process and how generative AI and emerging technologies offer hope and caution to caregivers looking to better connect with their patients.

Resources:

- Read Dircksen's recent article in Health Progress, "New Ways to Measure Impact in Communities"

- Purchase or download CHA's A Guide for Planning and Reporting Community Benefit

- Plan to attend Community Benefit 101, CHA's vital annual program which provides the basics of community benefit programming

- Transcript