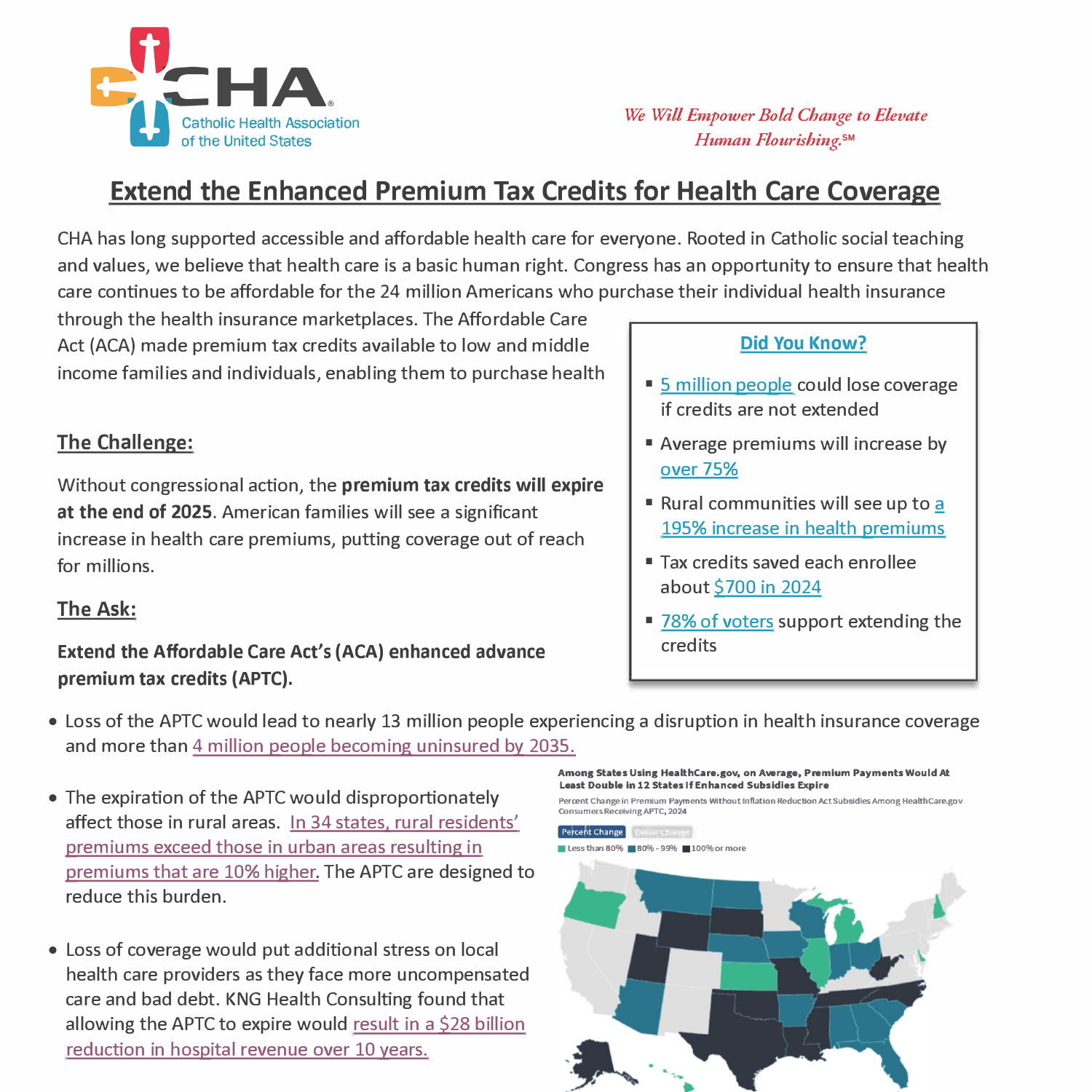

CHA wants health coverage purchased through the individual insurance marketplace to remain affordable for close to 24 million Americans who rely on it.

Specifically, we are working to preserve the health care tax credit that has made it possible for millions of working Americans to afford coverage since 2021. Without congressional action, this tax credit will expire at the end of 2025, and American families will see huge increases in their health care premiums, putting coverage out of reach for millions. On average, premiums will increase 93% if the tax credits are allowed to expire, and an estimated 5 million Americans will lose health coverage entirely, including nearly 2 million people with chronic conditions.

Advance Premium Tax Credit - Social Toolkit

Help spread the word about preserving affordable health coverage on social media with our images, animations and suggested posts.

Keep Americans Covered Coalition's Tax Credit Comparison Calculator

Keep Americans Covered Coalition's Tax Credit Comparison Calculator Keep Americans Covered Coalition's State-by-State Impact Map

Keep Americans Covered Coalition's State-by-State Impact Map