What has been steady growth in coverage under the health insurance exchanges set up under the Affordable Care Act could come to an end under budget plans making their way through Congress.

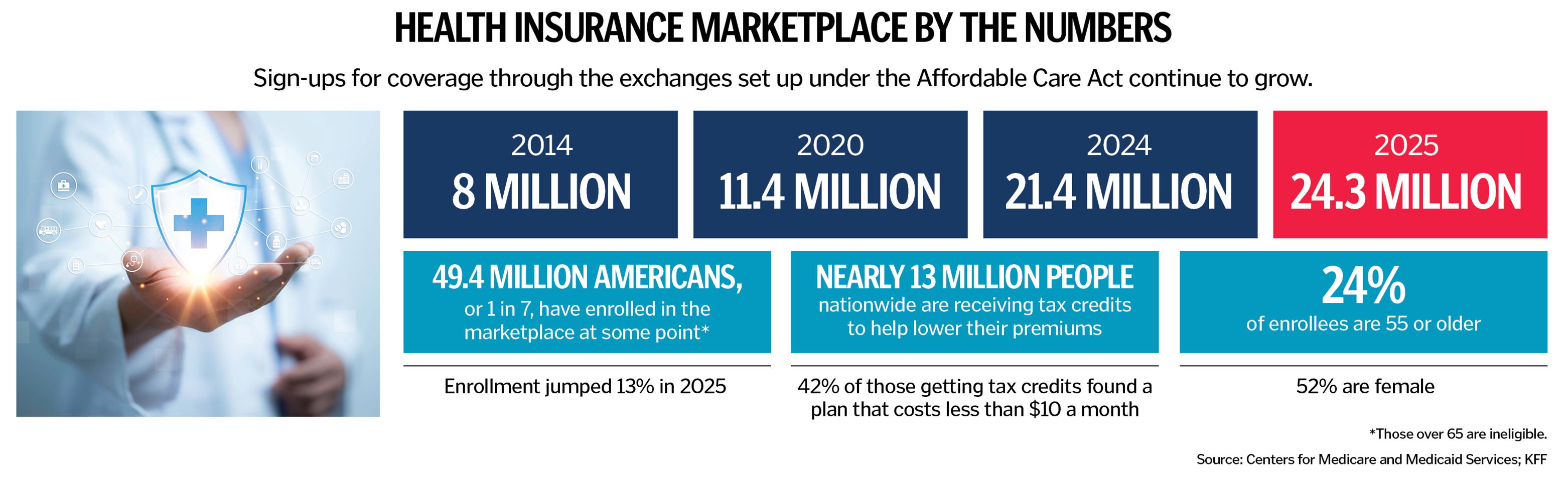

The Centers for Medicare & Medicaid Services reports that 24.3 million Americans are getting health insurance this year through the exchanges, also called the health insurance marketplace. The number is a 13% increase from 2024 and up from 8 million in 2014, the first year of the exchanges.

Meanwhile, an analysis released May 11 by the Congressional Budget Office found that if enhanced premium tax credits for those using the exchanges lapse, the number of people without health insurance will increase by 4.2 million in 2034.

The expanded credits were put in place in 2020 and will sunset at the end of this year unless Congress extends them. Legislation approved by the House Ways & Means Committee last week as part of budget planning assumes the credits will end.

The exchanges are open to any American who is not on Medicare. CMS says nearly 13 million people who use the exchanges are receiving tax credits to help lower their premiums. Of those, 42% are on plans that cost less than $10 a month.

In a press call on Tuesday hosted by CHA about the impact of proposed cuts to Medicaid, Trinity Health President and CEO Mike Slubowski noted that ending the enhanced premium tax credits could be a "double whammy" for care providers. The Congressional Budget Office has projected that the Medicaid cuts under discussion will cause 10.3 million Americans to lose coverage.

"The impetus has been to try to get people off Medicaid but have them purchase products on the exchange at discounted prices," Slubowski said. "If Medicaid goes away and the exchange options go away, people are going to be uncovered. It's pretty devasting when you think about the big picture here."

In a letter sent May 13 to the committee's chairman, CHA President and CEO Sr. Mary Haddad, RSM, expressed the organization's opposition to letting the enhanced premium tax credits lapse and warned of dire effects if they do. "On average, premiums will increase 93% if the tax credits are allowed to expire, and an estimated 5 million Americans will lose health coverage entirely, including nearly 2 million people with chronic conditions," the letter said.

In addition to the loss of coverage from ending the expanded premium tax credits, the Congressional Budget Office estimates a rule change for marketplace enrollees put in place by the Trump administration will cause another 1.8 million to lose coverage. The new rule includes a shorter enrollment period and stricter requirements for documenting income.

Further reading: Catholic health care leaders warn proposed Medicaid cuts could have devastating impact