By LISA EISENHAUER

Our Lady of the Lake Regional Medical Center in Baton Rouge joined a coalition of organizations determined to convince the Louisiana State Legislature in 2015 to rein in payday lenders, whose predatory practices were ensnaring some of the medical center's team members.

The coalition wanted the state to put an end to tactics that drive interest rates on the lenders' short-term loans outrageously high, in some cases up to 3,000%. Their effort didn't end well.

"We failed miserably," recalls Coletta Barrett, vice president for mission at Our Lady of the Lake. In effect, Barrett says the lawmakers told the coalition: "These poor people have no other options or alternatives. You just need to continue to let them be prey."

Rather than throwing in the towel, Our Lady of the Lake and others decided to take an if-you-can't-beat-'em-join-'em approach, but with a consumer-friendly twist. In 2018 they launched The Faith Fund.

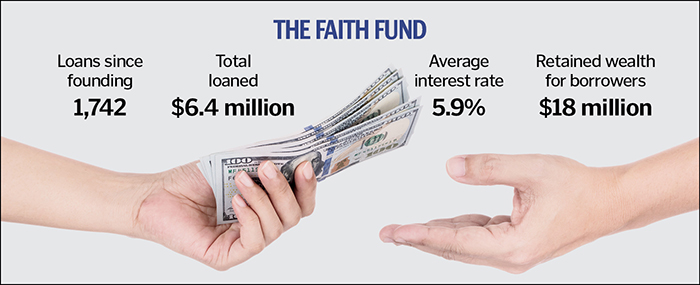

Since its founding, the microlending fund has provided 1,742 loans totaling $6.4 million at an average interest rate of about 5.9%. The fund's directors calculate that the loans have resulted in more than $18 million in "retained wealth," meaning money that otherwise would have gone to pay off interest and fees to payday lenders.

'Poverty is endemic'

Any resident of the Diocese of Baton Rouge can apply for a loan from The Faith Fund, although 95% so far have been to team members of Our Lake of the Lake or its parent system, Baton Rouge-based Franciscan Missionaries of Our Lady Health System. The system promotes the fund on its intranet and in employee communications.

The fund is a complement to the team member assistance program that FMOLHS started in 2005 to provide grants of amounts that vary depending on the circumstances to workers in urgent need of a onetime financial lifeline. Since 2021 the system also has offered its team members Payactiv, a service that lets them access earned income before payday.

Barrett says the three programs are evidence of the health system's commitment to its workers and to the common good. "If we can identify things that are pretty endemic in our population — and poverty is endemic — and we have access to sustainable resources to address the systems and structures that got them there in the first place, then that's our calling, to do what we can," she says.

The U.S. Census Bureau says 24.4% of Baton Rouge's population lives below the federal poverty level. That's more than double the national rate of 11.6%.

Payday lenders typically loan money to people who have incomes but little to no savings and poor credit. A review by The Pew Charitable Trusts found that Louisiana is one of 23 states with few consumer safeguards on payday lending. The review found that, on average, the cost to borrow $500 from a payday lender in Louisiana for four months was $435, or an interest rate of 405%.

Striking out alone

Barrett says it was because of the team member assistance fund that the system became aware of how many staffers had fallen victim to payday loans. Grant applicants are required to submit copies of their bills and financial statements. Although reviews of those documents now are done by a third party, they initially were done by a committee with representatives from various departments within the health system. Those committee members saw how payday loans often were at the root of their colleagues' financial hardship.

After getting the brush-off from the state legislature, Our Lady of the Lake in partnership with Catholic Charities of the Diocese of Baton Rouge decided to do an assessment of sustainable microlending programs. They won a $75,000 grant from the Catholic Campaign for Human Development, the domestic anti-poverty program of the United States Conference of Catholic Bishops, to fund the assessment.

Crystal Bell, rear, and her daughter Brenna Leigh Bell pose in front of the car Crystal was able to refinance through a credit union affiliated with The Faith Fund. The refinancing slashed the interest on the family's car payment by more than 50%. Crystal is an administrative assistant at Franciscan Missionaries of Our Lady Health System.

Crystal Bell, rear, and her daughter Brenna Leigh Bell pose in front of the car Crystal was able to refinance through a credit union affiliated with The Faith Fund. The refinancing slashed the interest on the family's car payment by more than 50%. Crystal is an administrative assistant at Franciscan Missionaries of Our Lady Health System.The study found that there were many alternatives to payday lending that were succeeding in other places with community support. The findings prompted Our Lady of the Lake and Catholic Charities to partner with MetroMorphosis, a nonprofit focused on urban renewal in Baton Rouge, to develop their own program.

The three put out a request for proposals for a fourth partner to take on the fiscal duties. They settled on the New Orleans Firemen's Federal Credit Union. As a community development financial institution, the credit union has a mission to provide financial services to communities that otherwise would have little access.

The partners set up an eight-member oversight board for The Faith Fund. Each organization appoints two members. Barrett is the board's executive sponsor.

Sustainable funding

A key part of making The Faith Fund sustainable was to identify a funding source to guarantee the loans. That happened with the help of Barrett's husband, a certified public accountant. He encouraged her to look into how FMOLHS was using the money left over from flexible medical spending and dependent care accounts. Employees fund those accounts with pretax earned income, but eventually unspent dollars revert to the employer.

It took Barrett several phone conversations to find those funds in the budget and then to get approval to have them transferred to the Our Lady of the Lake Foundation. From there, the money was redirected to launch The Faith Fund. The funds covered $50,000 in start-up costs for the loan program. Funds from that source also "reseed" the program as needed.

Depending on the size of the loan, the term usually runs one to two years. Borrowers do not have to put up any collateral, but they do have to agree to have loan payments withheld from their paychecks.

As part of the partnership, Our Lady of the Lake makes up 60% of loan defaults. The credit union secured a $1 million grant that it uses to cover the other 40%. So far, the fund's default rate has not exceeded 6.3%. That is below what Barrett says is the industry standard of about 10%.

While The Faith Fund initially was envisioned only as a means to provide payday loan relief, Barrett says applicants can request funds for other needs. One urgent need has been relief from car loan scams that are almost as predatory as payday loans. Through its partnership with the credit union, which has an arrangement with car rental giant Enterprise, the fund can help buyers get loans for year-old cars that remain under warranty.

'A huge blessing'

Crystal Bell is one of the FMOLHS team members who has turned to The Faith Fund for aid. Bell is an administrative assistant to three senior FMOLHS executives, including Pete Guarisco, senior vice president of mission integration. Bell says she was aware of The Faith Fund's mission since its launch but didn't expect to be one of its applicants.

Bell first applied for a loan in 2020, when her hours and pay were impacted due to the pandemic. She used the money to make ends meet until her full pay and hours resumed.

"That was a huge blessing to me," Bell says. "Being a divorced mom with three children, it was a struggle to look at possibly losing my income, so that helped me get through that."

She was still paying off her original loan when Hurricane Ida hit in 2021 and damaged her house. She got a second loan from The Faith Fund to cover those repairs.

Bell's car was ruined in a flood and she financed a replacement through a dealership. From The Faith Fund's financial counselor, Bell says she learned she could refinance her car loan through the New Orleans Firemen's Federal Credit Union. That change dropped her interest rate to 6.98%, less than half of what the dealership was charging. Her payments were cut significantly while the term of the loan was unchanged.

Bell says the assistance she has gotten through The Faith Fund has been "life changing." She is now one of FMOLHS' representatives on the fund's board.

Even though The Faith Fund's services are accessible online, its directors wanted a visible presence in the community. With a $150,000 grant from FMOLHS' sponsoring congregation, Franciscan Missionaries of Our Lady, The Faith Fund opened an office in an economically challenged part of Baton Rouge where many payday lenders have storefronts.

Barrett says the hope is that the office will help the fund become part of the fabric for uplifting the community by addressing issues such as intergenerational poverty.

Pay access with dignity

She describes The Faith Fund and the team member assistance fund as "great rescue and emergency strategies," but neither provided a means for workers to get in front of sudden expenses. That was why the system began offering Payactiv's service, to give employees access to their earnings without having to wait until payday.

In the fund's first years, 879 FMOLHS team members, about 5% of the almost 18,000-member workforce, have enrolled in Payactiv. Just under half are in the system's lowest pay rungs, earning between $12-$16 an hour; the rest are spread across the pay scale. The members' pay advance requests average about $100. To date, the advances total more than $2.8 million.

Payactiv didn't require any investment from FMOLHS except staff hours from information technology and human resources employees to set up access to payroll records.

Barrett says one of the blessings of Payactiv is that it empowers team members. Workers don't have to make an appeal to anyone or reveal any details of their finances to get their pay ahead of schedule.

"This is true dignity at work," she says. "I don't have to ask anyone's permission to access funds that I've already worked for and earned."

FMOLHS financial assistance programs

Franciscan Missionaries of Our Lady Health System offers its 18,000 team members several financial assistance and counseling programs.

Team member assistance fund: This fund offers onetime grants to workers with immediate needs. Workers must submit an application that includes bills and financial documents. They also must agree to financial counseling. The applications are reviewed by HOPE Ministries, a workforce development program that does the financial counseling. HOPE Ministries makes a recommendation to FMOLHS on whether to approve applications. There is no ceiling for grants.

The Faith Fund: Enrollment costs $5. Loan applicants get financial counseling and assistance applying for loans. Loan recipients agree to an affordable repayment plan with withholdings from their paychecks. A small portion of the loan repayments flow into a savings account for the loan recipient, meant to help them build a rainy day fund.

Payactiv: Enrollment is free. For a $5 fee, enrollees can make up to five transactions per pay period via a smartphone app. Workers don't need permission to access earnings prior to payday. The service also includes tools for budgeting, saving and managing debt.

Financial counseling: The system partners with Lincoln Financial Group to offer a variety of virtual and in-person classes on topics that include budgeting, investing, retirement, Social Security, and financial wellness. In 2022, 509 team members participated in these courses.