Advocacy Communications

View more

Read the Latest CHA Letters to Congress

-

12/12/2025

Joint Letter on 340B Rebate Program

-

12/10/2025

CHA Urges Congress to Seek Solutions for Health Care

-

12/01/2025

CHA Supports Maternal Health Legislation

-

11/25/2025

Joint Letter to CMS on HR 1 Implementation

-

11/24/2025

Joint Letter Urging Appointment of Chief Dental Officer

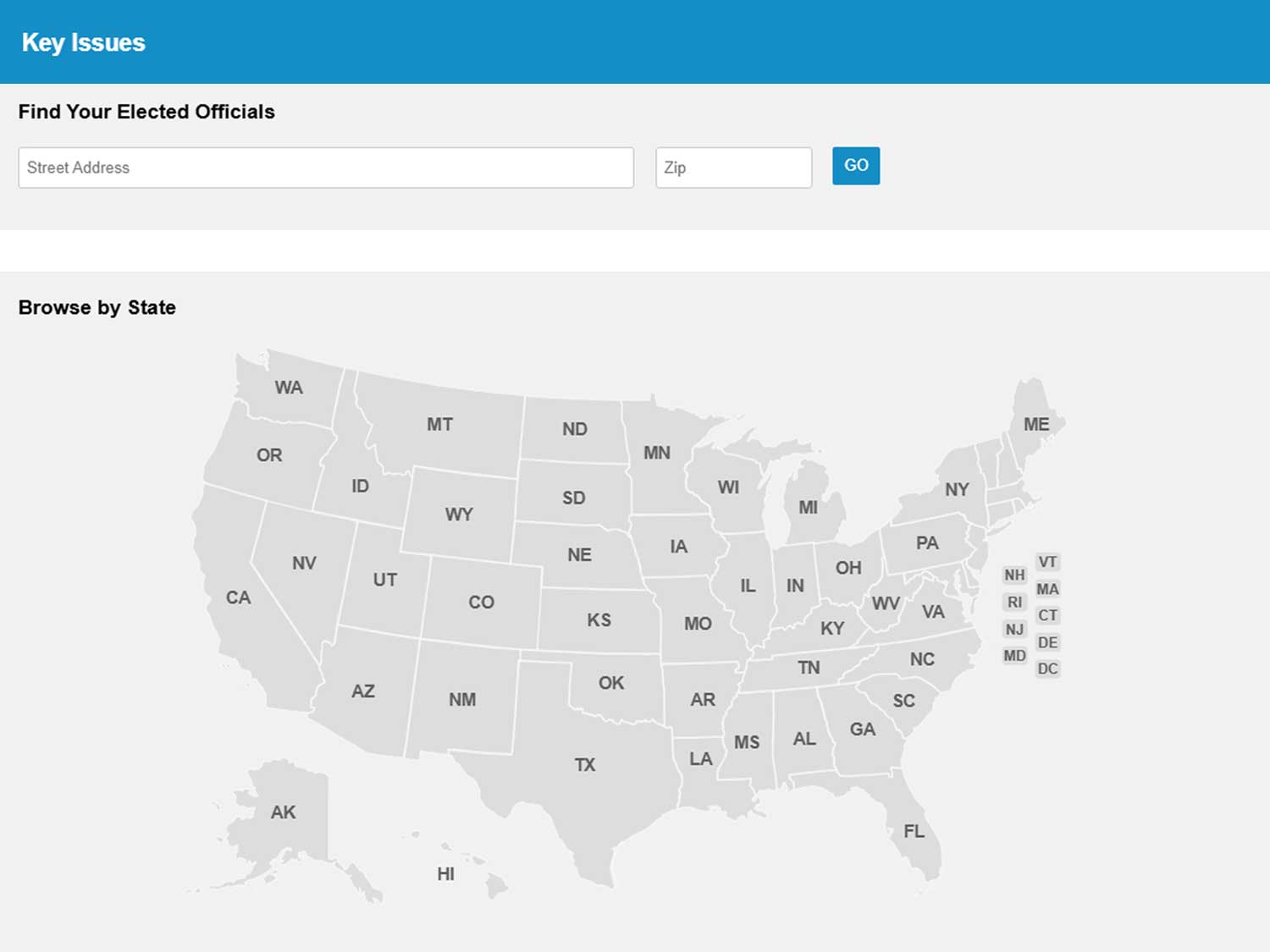

CHA's e-Advocacy

Contact Congress

The Catholic Health Association is pleased to make available e-Advocacy, a user friendly, web-based tool that will allow the ministry to participate more actively in our collaborative advocacy efforts.

e-Advocacy allows you to communicate directly with policy makers on issues important to the Catholic health ministry. Using e-Advocacy will allow you to immediately respond to CHA's advocacy alerts with form letters and talking points provided for your personalization and use.

Advocacy Agenda

As stated in our Vision, CHA advocates a health care system that is available, accessible and affordable to everyone and is designed to create and sustain a strong, healthy national and global community. The U.S. health care system should support and promote the health and well-being of every community, including rural and urban underserved areas.

Regulatory Summaries and Comments

-

11/26/2025

CHA Summary of Final 2026 OPPS

-

11/25/2025

CHA Summary of Final 2026 ESRD PPS

-

11/12/2025

CHA Summary of Final Medicare PFS Part III

-

11/10/2025

CHA Summary of Final Medicare PFS Part II

-

11/07/2025

CHA Summary of Final Medicare PFS Part I