BY: RYAN GISH, MBA and ANU SINGH, MBA

Suppose there were a Saint Amelia Hospital that joined a multiregional Catholic health system, resulting in clear and demonstrable benefits. For example, the hospital's operating costs declined after IT and materials management were centralized at the system level. Plus, care coordination and quality scores improved after the installation of a comprehensive electronic health record.

Despite these benefits as a member of a Catholic health system, Saint Amelia is facing challenges in terms of its financial position and its ability to transform itself for health care's emerging value-based payment system.

More than half of Saint Amelia's patient population is on Medicaid, and the hospital has had operating margins below 1 percent for several years — leaving little for the investments needed to attract commercial payers that are forming networks in the region.

Margin also is challenged by a cost structure higher than that of other organizations in the market. Inpatient volumes are declining in several key service lines, while Saint Amelia's outpatient market share is being challenged by several freestanding facilities that offer lower prices and longer hours.

Meanwhile, the Catholic system that owns Saint Amelia is balancing the needs of its expanding portfolio, which includes many strong-performing hospitals as well as several that are financially stressed. At the same time, Saint Amelia — along with its parent system — recognizes an organizational transformation will be needed in order to make the shift to value-based payment and population health management, particularly in the areas of delivery network breadth, care management, patient engagement and contract management.

Based on Skokie, Illinois-based management consultants Kaufman, Hall & Associates' experience with health care clients, along with the growing number of published accounts, it is clear that scenarios like the Saint Amelia example play out in real life across the Catholic health care ministry. For secular and Catholic organizations alike, some form of partnership often is viewed as a means to address financial challenges and to achieve strategic goals.

Traditionally, mergers and acquisitions have involved financially stronger organizations acquiring financially weaker ones, frequently in order to increase scale. More recently, organizations are turning to more creative partnerships and affiliations as a way to position themselves for success under the emerging value-based payment and population health management model within the unique dynamics of each market.

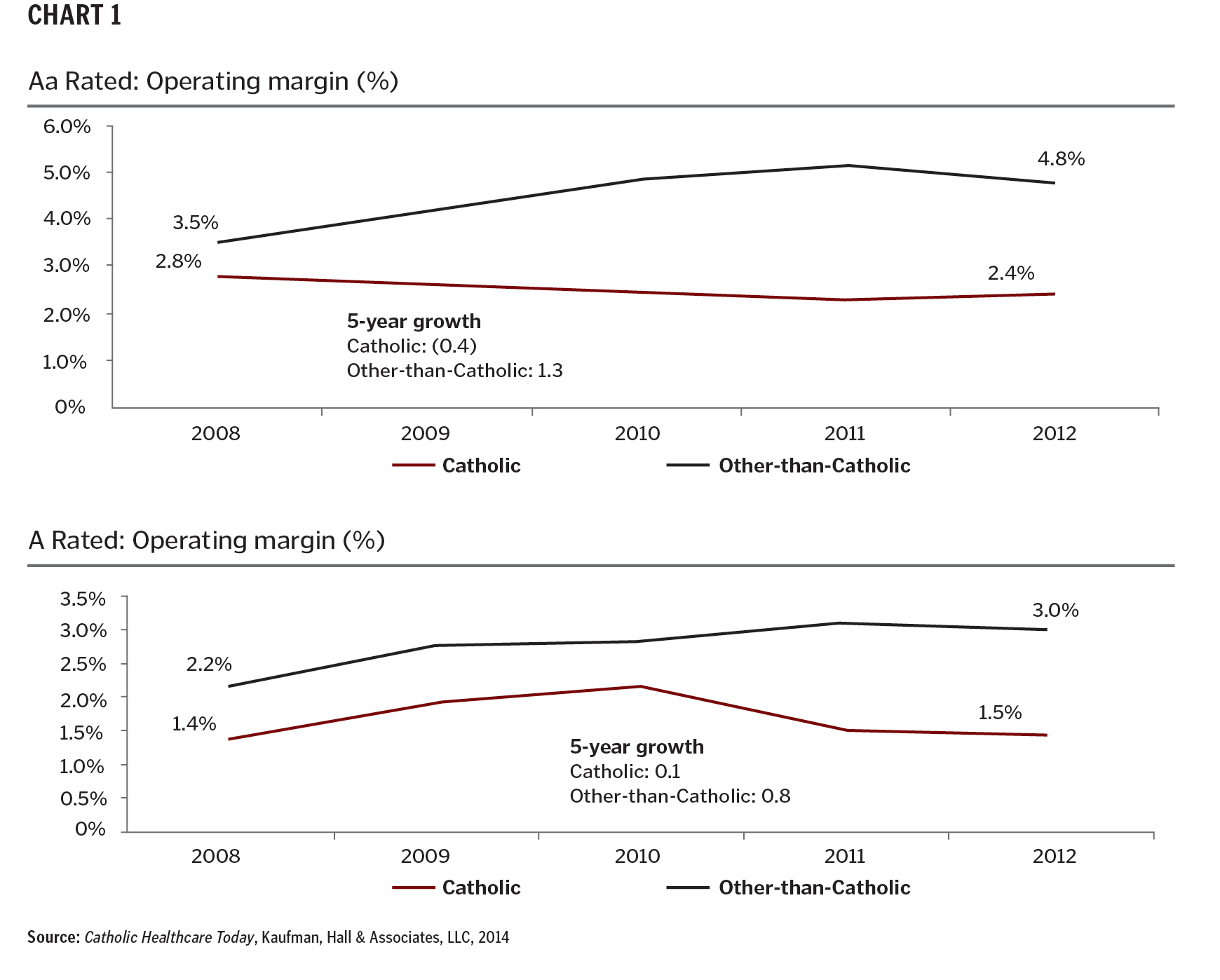

The Catholic focus on mind, body and spirit aligns well with the holistic approach advocated under population health management. However, some Catholic health care organizations find themselves increasingly challenged to invest in the organizational transformation needed to manage the health of a population under value-based payment while continuing to fund mission-oriented programs or markets. For evidence of this challenge, consider Chart 1, above, based on data from Moody's Investors Service comparing financial performance of Catholic organizations with that of other-than-Catholic organizations between 2008 and 2012.

In 2012, the average operating margin among Aa rated Catholic organizations was 2.4 percent lower than that of other-than-Catholic Aa rated organizations, and the operating margin of A rated Catholic organizations was 2.5 percent lower than that of A rated, other-than-Catholic organizations. Perhaps more important, in the five-year period between 2008 and 2012, the gap between Catholic and secular health systems grew by 1.7 percent for Aa rated organizations and 0.7 percent for A rated organizations, with margins of Catholic organizations in those ratings categories essentially flat. If this gap continues to grow, it will be harder for Catholic organizations to thrive, especially in hypercompetitive markets.

As they consider how their organizations will need to position themselves, Catholic health care leaders need to engage in a rigorous and disciplined strategic analysis of their market footprint and service mix. Only then can they intelligently sort through their strategic options.

PLANNING BEFORE PARTNERING

Any effective strategic-financial analysis should include a fact-based evaluation of the current state, creation of future objectives and careful assessment of strategic options, including a potential role for partnerships. For an individual hospital or small health system, this may mean reconsidering the organization's portfolio of services and its role in the community. In other cases, it may mean consideration of fully joining another system. Multisite health systems should assess each of their markets and how they fit within the system's overall mission and strategy.

Four basic phases will be critical as Catholic leaders go through this planning process:

1. Analyze the organization's current strategic and financial position

This analysis begins by defining the value that the organization aims to deliver. Value can be defined in many ways, such as through the lens of the Triple Aim: improving the patient experience of care (including quality and satisfaction), improving the health of populations and reducing the per capita cost of care. Of course, this value must be delivered with sustainable financial performance. In addition, there is the value inherent in the Catholic mission: Catholic health care organizations have a long history of and commitment to improving the quality of life for the poor and vulnerable.

The organization will have to identify performance metrics that adequately reflect — and balance — various dimensions of value. By tracking how different components of the organization perform across a balanced set of dimensions, leaders can have informed discussions about which services, programs or markets show the greatest promise and which have material challenges and require an alternative path.

2. Ask hard questions about the organization's service mix

Leaders need to maintain an open mind during strategic discussions, even regarding historically important services. For instance, using the hypothetical example of Saint Amelia Hospital, a generation ago most women in the community had their babies there. Now, however, Saint Amelia has trouble filling its obstetrics beds after a competitor recruited coveted obstetricians and invested in a state-of-the-art neonatal intensive care unit and birthing suites. Plus, a new expressway has made it easy to get to the competing hospital from all directions.

Should Saint Amelia close its obstetrics unit and partner with the competing hospital to ensure that women in the community have needed care? If so, what other services could Saint Amelia develop or expand to ensure its market relevance in the future — and protect its ability to serve the poor and vulnerable? The answer increasingly is being influenced by the value that Saint Amelia can offer to its patient base.

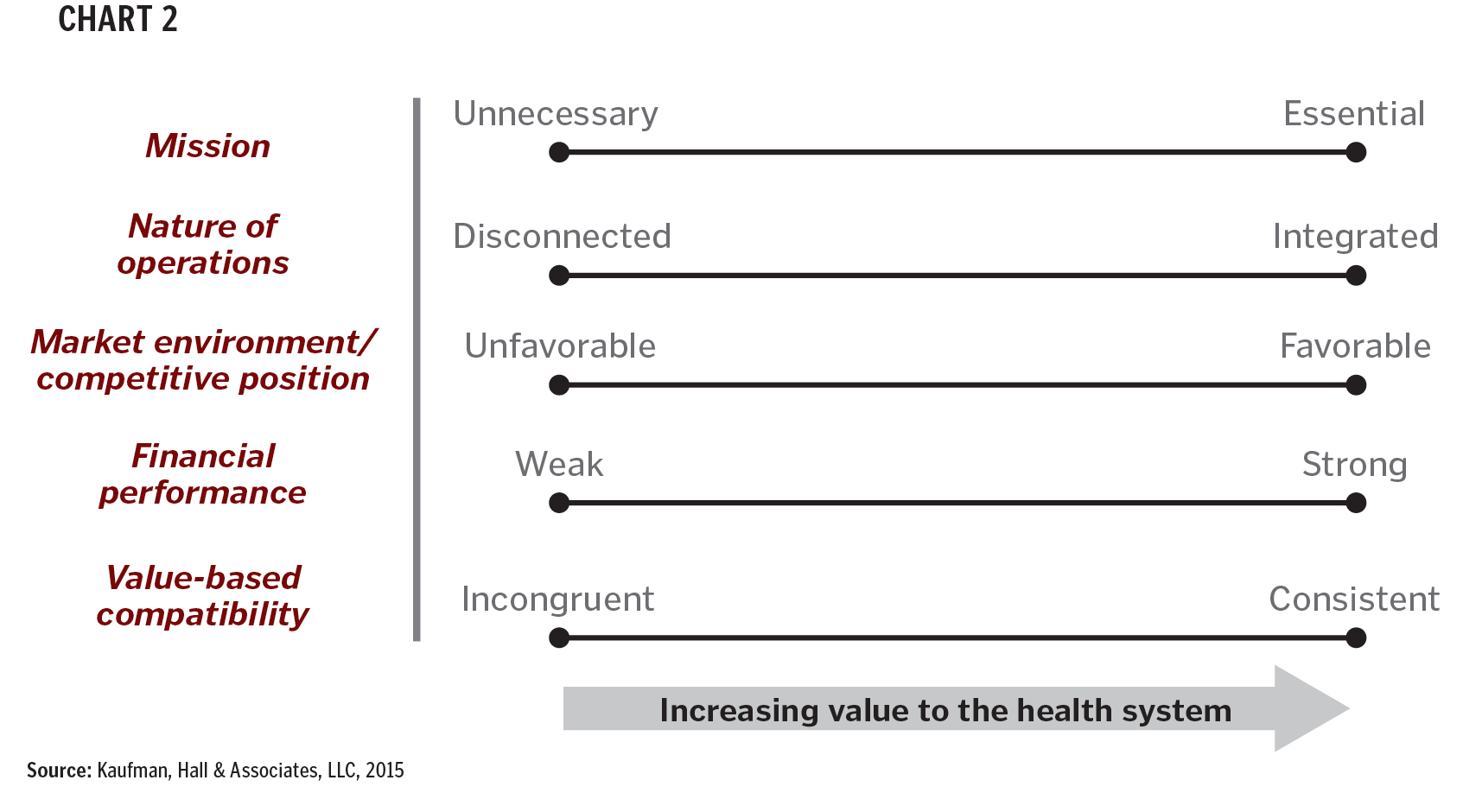

Most hospitals and health systems have evolved into conglomerates that react to industry incentives, market opportunities and community needs. As payment shifts to a value-based model, progressive organizations are re-evaluating all aspects of their business in light of changing market conditions and requirements for success. At a business unit or program level, health systems should consider the following (see Chart 2):

- Mission essentiality: Overarching importance of the business required to achieve the mission

- Nature of operations: Degree to which the business is fully integrated into the fabric of the institution

- Market environment and competitive position: Comparative cost and quality position as well as expected changes in the operating environment

- Financial performance: Direct and indirect impact of the business unit on the financial performance of the organization

- Value-based compatibility: Importance of the business relative to the desired care delivery model within the construct of value-based care

3. Consider the difference between presence and relevance

Former GE CEO Jack Welch, who oversaw a 4,000 percent increase in company stock, famously said about GE's various business lines, "Be No. 1 or No. 2, or get out."1 This approach has relevance in health care today, as hospitals and health systems attempt to assess which of their many services and units has the potential to be a leader in an era of changing demand and new competition.

Even as the business model begins to shift, many hospitals still are dependent on revenues from high-end inpatient specialties, such as orthopedic and cardiovascular services. Yet inpatient volume is declining as more care moves into the less costly outpatient setting. As a result, competition for inpatient volume is intensifying.

Health systems also are facing pressure in the outpatient arena as nontraditional competitors seek health system market share among consumers who, shouldering a greater portion of their health care costs, increasingly are comparison shopping based on price and convenience. As a result, hospitals face the need to rethink their sites of care and mix of services for both inpatient and outpatient care in light of competitive pressures, changing approaches to care and rising consumerism.

If they are going to weather these competitive battles and thrive over the long term, Catholic health systems need to demonstrate high relevance and value. Simply being present in a market won't be enough. Leaders will need to ask: Which of our programs or markets have the greatest potential for success? How do we need to position our services to achieve that success? For example, do we need to grow, build a continuum of care, lower costs, improve quality or patient experience, and create a new pricing model?

Catholic health care leaders face the added challenge of sometimes being the only player in the market with a deep-seated commitment to providing needed services to the poor and disadvantaged. The key is finding the right balance between margin and mission.

4. Assess the potential of partnership as a vehicle to attain goals

A range of partnerships may be appropriate to consider when attempting to establish a market position that is durable for the long term. In some cases, traditional mergers and acquisitions may be the right solution. In other cases, something short of ownership — such as a joint operating agreement, management services arrangement or minority ownership investment — may be best. It all depends on the two partnering organizations' specific situation and the goals.

Many progressive organizations are recognizing that they no longer have to unilaterally own and control everything to achieve organizational goals. Assume, for example, that the hypothetical Catholic health system that owns Saint Amelia wants to build a network of high-quality, high-efficiency providers as a mechanism to differentiate itself in the competitive market. The system lacks the geographic footprint to pursue this strategy on its own. It may find an opportunity to create a clinically integrated network with another system, right in Saint Amelia's backyard. The two systems wouldn't have to merge, because the end goal is not to create size and scale but to establish market relevancy.

If successful, the hypothetical partnership in Saint Amelia's backyard would be considered a "win-win." The two health systems both would be able to extend their markets and secure the requisite patient population without losing their autonomy. However, partnering to enter a new market or expand a service is not the only way to improve positioning and achieve the organization's goals. Sometimes rethinking the care delivery model is the preferred approach.

For example, Saint Amelia has an agreement with a local rehab facility to provide post-acute care. After identifying orthopedic surgery as a high-value service, Saint Amelia leaders begin to think about the continuum of care for joint replacement patients: "What if we owned the rehab facility? What if we were able to improve patient outcomes and reduce the facility's expense base? Would this put us in a better position to assume risk through a bundled payment contract? How would owning the facility change the value we can provide?"

After running some financial projections, the leaders might find that the organization would be better off acquiring the facility than participating in a lighter form of collaboration.

EXAMPLES OF CATHOLIC PARTNERSHIPS

Several Catholic health care organizations have entered into various types of unique partnerships formed to achieve market-specific goals. While these partnerships are in the early phases, they illustrate a potential path forward in the increasingly demanding marketplace. Here are some examples of goals that brought systems together:

Forming a network for population health management. In 2014, two Catholic health systems — Ascension Health and Trinity Health — formed a clinically integrated network that spans the state of Michigan, where they both already had significant presence. The two health systems are funding equally a joint management company called Together Health Network, which is set up as a limited liability company to handle managed care contracting.

As the network develops, an estimated 75 percent of state residents will be within 20 minutes of one of the network's hospitals, ambulatory centers or physician offices, according to a press release. Rounding out the continuum of care, Together Health Network also includes home care agencies, skilled nursing facilities and other post-acute providers.

The partnership — which does not merge any assets — is focused on providing value-based population health management. Both Ascension Health and Trinity Health recognized that "payers and employers demanded a new approach that focuses not solely on episodic care but rather a coordinated continuum of value-based services that keep populations healthy."2

Together Health Network is working with payers to develop a range of value-based health plan products (e.g., shared savings, pay-for-performance, bundled payment) for the commercial market, the state health insurance exchange and self-insured employers.3

In addition to sharing a geographic footprint, the two systems have complementary sets of skills and assets. Each already had invested significant time and dollars integrating with physicians, building high-quality clinical programs and reducing unnecessary costs — all of which are major selling points for payers and employers. The fact that the joint management company is physician-led (i.e., has a physician CEO and a physician-majority board) is a key tenet of the network, helping to ensure the tradition of high-quality care.4

Both organizations also came together under a shared mission and vision and see the network as "an outgrowth of the two organizations' mutual commitment to Catholic health care," according to their announcement. Network leaders see their population health strategy as a way to extend the Catholic ministry and help ensure better access to care for all.

Securing a local partner for market relevancy. A different type of partnership is unfolding in the Hudson Valley region of New York State. Back in 2012, this 6,000-square-mile area had 37 hospitals — along with an excess of at least 1,700 hospital beds. Many of the hospitals across the suburban and rural territory were in financial trouble.5

That was the case for the three-hospital Bon Secours Charity Health System, which is part of the multiregional Bon Secours Health System. Between 2012 and 2014, the three-hospital Charity Health System recorded a series of annual operating losses.6

Meanwhile, the regional tertiary system, Westchester Medical Center, was seeing rapid regional consolidation of hospitals and physicians, largely driven by the entrance of New York City-based systems into the Hudson Valley.7

In the spring of 2015, Bon Secours Charity Health and Westchester Medical Center formalized months of partnership talks. Rather than pursue a full merger, Westchester Medical assumed 60 percent economic membership interest in the system and control over operations. Bon Secours Charity Health maintains a 40 percent minority economic membership interest.8

Westchester Medical is not a Catholic health system. Formerly a county hospital, the facility is now a public benefit corporation, which allows the organization to maintain its public mission to treat anyone in need of advanced medical care.9

The minority interest agreement allows Bon Secours Charity Health to remain Catholic. In addition, with Westchester Medical's guaranteed backing, the Catholic system was able to secure $122 million in taxable fixed-rate bonds to make needed investments, maintain market viability and continue its ministry.

While Westchester Medical saw its bond rating decrease from one agency after the joint venture, the rating agency expressed confidence in the system's abilities to help turn around the Catholic system and achieve its goal of building a patient-centric network of outpatient primary care and specialty care services available close to home. The creative approach increases the market relevance for both organizations simultaneously.

Partnering for resource-sharing and efficiencies. Meanwhile, in the Chicago suburbs, a market-based partnership was finalized between Alexian Brothers Health System and Adventist Midwest Health. The two mid-sized, faith-based systems — one Catholic and the other sponsored by the Seventh-day Adventist Church — created a joint operating company that combines the corporate operations of both systems under one roof. Although the two systems represent different faith traditions, they share common missions and values, which was a key factor in the affiliation.10

Both systems are part of major national systems: Ascension Health and Adventist Health System. An executive at Ascension Health said the partnership is part of the national system's commitment "to building regional clinically integrated systems of care to better serve individuals in the markets we serve across the nation."11

The partnership was launched during a time of considerable consolidation in the Chicago area. The combined systems now include nine hospitals and 3,000 physicians across a wide suburban geography that has a combined population of more than 3.8 million people.

The arrangement is short of a full merger. The joint operating company allows the two organizations to maintain separate ownership of assets and to preserve their religious identities and mission priorities.

The two systems have worked to brand the partnership under one name: AMITA Health. The websites of both systems now bear the name AMITA Health alongside the system name. The two systems are positioning themselves as a single, high-quality provider that intends to integrate care across the organizations.12

One early success factor for this partnership is determining which of the two organizations will provide various support and back-office functions — and then ensuring that the other organization's service needs are being met.

A BROAD VIEW OF PARTNERSHIPS

As these examples illustrate, there is no single partnership solution. Leaders of Catholic health care organizations need to consider their partnership options on a business-by-business and market-by-market basis. Depending on the goals in a particular community, the right partnership could be a network with another Catholic partner or it could be a joint venture with a secular not-for-profit or even — under the right circumstances — a for-profit organization.

Achieving "Triple Aim" goals will require organizations to cross traditional boundaries, both in terms of care delivery models and potential partnerships. Many Catholic health care leaders may find themselves having to challenge traditional notions. In other words, Catholic leaders will need to take a catholic — that is, a universal or all-encompassing — view of partnerships.

RYAN GISH and ANU SINGH are managing directors, Kaufman Hall & Associates, LLC, Skokie, Illinois.

NOTES- Amir Hartman, "The Competitor: Jack Welch's Burning Platform," in Ruthless Execution: What Business Leaders Do When Their Companies Hit the Wall (Upper Saddle River, N.J.: FT Press, 2003).

- Together Health Network, "Health Systems Announce Launch of Physician-Led Together Health Network," news release, May 7, 2014. www.togetherhealthnetwork.org/thn-release.pdf.

- Jay Greene, "Ascension Health, Trinity Form Managed Care Contracting Company," Crain's Detroit Business, May 12, 2014. www.crainsdetroit.com/article/20140507/NEWS/140509882/ascension-health-trinity-form-managed-care-contracting-company.

- Together Health Network, "Quick Facts & Locations," www.togetherhealthnetwork.org/facts.html (accessed June 29, 2015).

- Hudson Valley Pattern for Progress, Aging in the Hudson Valley: Is the Healthcare System Ready? July 2014. http://pattern-for-progress.org/aging-healthcare/.

- David Robinson, "Downgraded: Westchester Medical's Credit Rating Drops," Lohud: The Journal News, May 12, 2015. www.lohud.com/story/news/local/2015/05/12/westchester-medical-center-credit-rating-downgraded/27201735/ (accessed July 24, 2015).

- Westchester Medical Center, Westchester Medical Center 2020: Developing a Hudson Valley System of Care, www.westchestermedicalcenter.com/documents/WMC/2015-StrategicPlan.pdf (accessed June 29, 2015).

- John Commins, "Westchester Medical Takes Majority Ownership of NY's Bon Secours Charity Health," HealthLeaders Media, May 22, 2015. www.healthleadersmedia.com/page-2/COM-316621/Westchester-Medical-Takes-Majority-Ownership-of-NYs-Bon-Secours-Charity-Health (accessed July 24, 2015).

- Westchester Medical Center, "History," www.westchestermedicalcenter.com/body.cfm?id=424 (accessed June 29, 2015).

- Andrew Wang, "Alexian, Adventist Agree to Form Nine Hospital System," Crain's Chicago Business, June 17, 2014. www.chicagobusiness.com/article/20140617/NEWS03/140619827/alexian-adventist-agree-to-form-nine-hospital-system (accessed July 24, 2015).

- Ascension Communications, "Alexian Brothers Health System, Adventist Midwest Health Form Joint Operating Company," Feb. 9, 2015. www.ascension.org/Newsroom/TabId/99/PostId/223/alexian-brothers-health-system-adventist-midwest-health-form-joint-operating-company.aspx (accessed July 24, 2015).

- AMITA Health, "Our Story," www.amitahealth.org/our-story (accessed July 24, 2015).