BY: CINDY MANN, JD, and ADAM STRIAR, MPA

Although efforts to cap federal funding for the Medicaid program have faded from the limelight since Congressional attempts in 2017 failed to repeal the Affordable Care Act, such proposals continue to be advanced. The President's FY 2019 budget calls for a block grant to replace uncapped funding for the Medicaid expansion, with most other federal Medicaid spending subject to a per-person cap. During the summer of 2018, a consortium of conservative thought leaders released a new proposal that bears close resemblance to the 2017 "Graham-Cassidy" repeal bill and proposes capping federal support for the Medicaid program. Proposals to restructure Medicaid financing also have been advanced in the context of initiatives to reduce the federal deficit and "reform" federal entitlements. Although the 2018 midterm elections changed the political landscape, the recurrence of proposals to cap federal Medicaid funding and the $779 billion federal deficit for fiscal year 2018, suggest that federal Medicaid caps will continue to be an issue of interest to lawmakers.

Capping federal Medicaid funding would unravel the federal government's historical role of sharing financial responsibility with the states for the Medicaid program. Recent proposals would have resulted in steep cuts in federal support for the range of health care services and long-term services and supports provided to the approximately 73 million people enrolled in Medicaid.1 Currently, the federal government and states share in all costs associated with running the Medicaid program, but capped federal funding would leave states at risk for increases in health care costs and, depending on the design of the proposal, growth in enrollment. Such proposals inevitably would require states to make tough decisions about whether to increase their own spending in order to make up the lost federal share or cut back on coverage, benefits and access in order to keep spending within the cap. Medicaid provides critical health care and long-term services and supports to many of the most vulnerable members of our society, including the elderly and disabled. A fundamental redesign of the Medicaid program's financing puts the health and well-being of these individuals in jeopardy.

FINANCING MEDICAID

Since Medicaid was established in 1965, the federal government and the states have shared responsibility for financing the program, with the federal government providing a legal commitment to match state spending on authorized program costs. These include medical care, long-term services and supports and administrative costs. For most Medicaid spending, the federal share is determined by each state's federal medical assistance percentage. States with relatively lower per capita incomes receive higher matching rates.

For example, Mississippi has a 76.39 federal medical assistance percentage, meaning the federal government reimburses the state for more than $3 out of every $4 spent on Medicaid. The minimum federal medical assistance percentage is 50 percent.

States also receive different federal medical assistance percentages for administration and certain benefits and populations. One example is adults who qualified for Medicaid coverage through the ACA expansion for whom states receive no less than a 90 percent match. Shared financing of all Medicaid costs provides states — and ultimately beneficiaries and health care providers — with protection against fluctuations in health care spending and enrollment. If health care costs spike in a given year due to the introduction of a new drug therapy or cancer treatment, for example, under the current structure the federal government is still responsible for its share of total allowable program costs. Similarly, if the need for coverage increases due to circumstances well beyond the state's control — such as an economic downturn — the federal government also must cover the required share of program costs. In both cases, state costs will increase, but they are mitigated by the federal financial commitment.

CAPPED FUNDING PROPOSALS

Proposals to cap federal Medicaid funding generally have taken two approaches that are not mutually exclusive. Both were included in the Graham-Cassidy proposal that Republican lawmakers considered in 2017.

Block grants. Block grants can take a number of different forms, but generally they provide states with a set amount of federal funding each year, regardless of actual program costs or enrollment. They are attractive to some federal policymakers because they provide a high degree of budget certainty to the federal government. Details of block grant proposals vary. Historically, Medicaid block grant proposals have allowed capped payments to grow each year based on a national trend rate, such as growth in gross domestic product or the rate of inflation, and they may or may not have a state spending requirement. Currently, Medicaid reimburses states only for the federal share of actual program spending, but block grants in other federal programs do not necessarily require this. The lack of a state spending requirement likely would add to the federal spending reductions.

Per capita caps. Per capita cap proposals also vary widely in their structure, but in one way or another, they cap the amount of federal spending on Medicaid on a per-person basis. Per capita caps are similar to block grants in that, even with a national trend rate adjuster, they do not grow based on actual health care costs. However, they differ in that the total amount of federal funding available to a state would depend on the number of individuals enrolled. In most per capita cap proposals, the caps are set based on state spending in an earlier base period trended forward by a national trend rate.

Block grants and per capita caps have been designed in different ways, but proposals generally adhere to the basic structures described above. The American Health Care Act (AHCA), passed by the House of Representatives in May 2017, proposed per capita caps across the five major Medicaid eligibility categories beginning in FY 2020 while eliminating enhanced federal matching funds for the Medicaid expansion over time. Another proposal, the Better Care Reconciliation Act (BCRA), which ultimately was voted down by the Senate in July 2017, also included a Medicaid per capita cap and phased down the enhanced match for adults who received coverage through the expansion but made some minor changes to trend rates and affected populations. It also added a new provision to redistribute funds among states. In both proposals, some eligibility groups (including the elderly and the disabled) were assigned higher trend rates than others. However, both imposed an aggregate cap relating to all or most program spending, meaning that groups subject to a higher trend rate or no cap at all would not be protected from program cuts promoted by the aggregate cap. Each proposal also contained an option for states to elect a block grant for certain populations in lieu of a per capita cap.

Graham-Cassidy remains Republican lawmakers' preferred approach to capping Medicaid funding despite the Senate's decision in 2017 to call off a vote rather than risk defeat on the floor. The proposal contains many of the same features of AHCA and BCRA, including a per capita cap on most federal Medicaid spending (albeit with slightly different trend rates for certain groups) and an aggregate cap relating to most program spending. However, instead of phasing down the enhanced match for expansion adults, Graham-Cassidy proposed to eliminate the Medicaid expansion and the health insurance marketplace and divert funding to a block grant to states, accompanied by broad flexibility as to the uses of those block grant funds.

IMPLICATIONS OF CAPPED FUNDING

All major capped funding proposals to date — including AHCA, BCRA and Graham-Cassidy — have been designed in ways that would lead to large cuts in federal Medicaid spending. The proposals achieve this in several ways, including by setting the trend rate at a level designed to fall below expected actual growth in health care spending.

But in addition to cuts that can be projected based on estimates of Medicaid spending, capped funding would create additional risks to state Medicaid programs that are difficult to measure. The pressure comes from each of the design components of a capped financing structure. For example, caps typically are set based on historic spending. A state that has a low-spending base period (for example, due to low provider rates or a narrow benefit package) will have little ability in future years to draw down federal dollars to improve access or benefits.

In addition, caps leave states, health providers and ultimately individuals and families — but no longer the federal government — to bear the risk of unexpected costs that are almost certain to occur.

In addition, caps leave states, health providers and ultimately individuals and families — but no longer the federal government — to bear the risk of unexpected costs that are almost certain to occur.

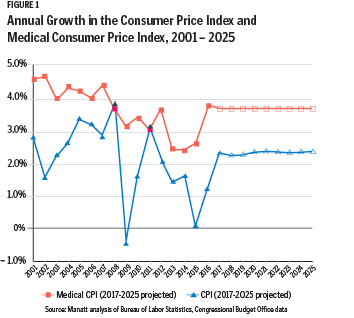

Unanticipated costs are common occurrences in health care. For example, public health crises (such as the HIV/AIDS crisis, the opioid crisis), natural and man-made disasters (hurricanes, 9/11, lead poisoning) and costly breakthrough medications or treatments (the hepatitis C vaccine) will cause costs to rise. But under capped funding proposals, federal funding would no longer reflect actual costs or the on-the-ground circumstances in each state. The trend rates themselves also are problematic; often they are derived from baskets of goods and services that do not reflect the key drivers of Medicaid costs (such as nursing home care) and are prone to considerable fluctuation from year to year (see Figure 1).

In addition to these risks, block grants typically do not adjust allotments based on the number of people enrolled. Spikes in enrollment can be caused by a range of factors, including economic downturns (which tend to increase Medicaid enrollment) and natural disasters (which might increase the number of eligible people).2 Under a block grant scenario, states would be placed at financial risk for situations like these that lead to growth in enrollment and ultimately increase program spending.

POTENTIAL IMPACT ON FEDERAL FUNDING

POTENTIAL IMPACT ON FEDERAL FUNDING

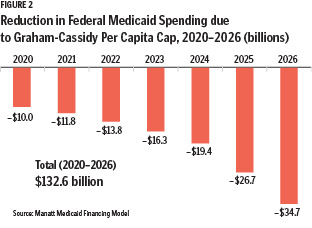

Using the Manatt Medicaid Financing Model,3 we estimated the impact of the Graham-Cassidy proposal on federal Medicaid funding for states and found that it would result in substantial cuts. The loss of federal funding for expansion alone would result in a 21.6 percent reduction ($718.1 billion) in federal Medicaid spending nationwide from 2020 to 2026. Per capita caps would result in an additional 4.0 percent decrease ($132.6 billion) in federal funding over this same time period (see Figure 2), with cuts deepening to 6.1 percent by 2026. In total, our modeling suggests that states would see a total cut of $850.7 billion in federal Medicaid dollars over this time period (25.6 percent) as a result of the Graham-Cassidy Medicaid expansion and per capita cap provisions.4 These estimates are consistent with the Congressional Budget Office's analysis of the proposal, which shows that Graham-Cassidy would reduce federal spending on Medicaid by about $1 trillion over the 2017–2026 period while covering millions fewer enrollees.

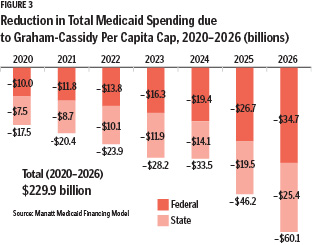

These federal cuts also could be deepened by reductions in state Medicaid spending. States may choose to backfill lost federal dollars, but our modeling shows that this would require states to come up with an additional $132.6 billion over the 2020–2026 period, with state costs growing over time. But many states would not backfill the federal cuts and instead would spend only what is required to receive the full amount of federal payments allowed under the caps. This would cause total spending cuts to deepen substantially. If we assume that all states will do this, combined state and federal cuts attributable to the Graham-Cassidy per capita cap would total $229.9 billion over the 2020–2026 period (see Figure 3).

Taking a retrospective look at previous proposals to cap federal Medicaid funding against actual Medicaid spending tells a similar story. Jeanne M. Lambrew examined earlier proposals to institute block grants in Medicaid and compared them against actual spending.5 The analysis showed how the caps deepen the cuts over time: A 1981 block grant proposal would have resulted in a 6 percent reduction in Medicaid federal funds over five years, but this rises to a 26 percent reduction over 10 years, including a 53 percent reduction in the 10th year alone.

CONCLUSION

Capped funding provides budget certainty — and likely savings — to the federal government by shifting risk to state Medicaid programs, health providers and, ultimately, Medicaid enrollees and their families. To the extent that caps cause federal funding to fall short of actual need, states would be required to make decisions about whether to replace lost federal funds or explore ways to cut program spending. For states that do not backfill, capped funding proposals are likely to have an outsized impact on beneficiaries who are more costly to cover, such as the elderly and people with disabilities. In FY 2014, more than 60 percent of Medicaid spending was on those two eligibility groups, despite their making up only 21 percent of enrollees.6, 7 These groups also are more frequent users of long-term services and supports, which accounted for 30 percent of total Medicaid spending in FY 2016.8

Depending on the size of the federal cuts they face, states could have a difficult time keeping within their capped spending limits without reducing coverage and services for high-cost enrollees. Further exacerbating this problem is the fact that elderly and disabled populations are responsible for a large share of optional Medicaid spending, which is where states have more opportunities under federal law to make spending reductions. In FY 2013, 77 percent of optional Medicaid spending was on individuals with disabilities and those age 65 and older.9

Depending on the size of the federal cuts they face, states could have a difficult time keeping within their capped spending limits without reducing coverage and services for high-cost enrollees. Further exacerbating this problem is the fact that elderly and disabled populations are responsible for a large share of optional Medicaid spending, which is where states have more opportunities under federal law to make spending reductions. In FY 2013, 77 percent of optional Medicaid spending was on individuals with disabilities and those age 65 and older.9

Interest in capped funding for Medicaid continues as the president and lawmakers consider options for another try at repealing the ACA or, perhaps more likely, given the midterm elections, a package aimed at deficit reduction and entitlement reform. If caps are imposed, most states would have little choice but to make substantial cuts to their existing programs, potentially placing all of those served by Medicaid, including the elderly and people with disabilities, in jeopardy.

CINDY MANN is the former deputy administrator and director of the Center for Medicaid and CHIP Services in the Centers for Medicare and Medicaid Services, where she led the administration of Medicaid, CHIP and the Basic Health Program for more than five years during the implementation of the Affordable Care Act. She now is a partner with the Manatt Health Team in Washington, D.C.

ADAM STRIAR is a manager with Manatt Health. He provides policy analysis and strategic support to various health care stakeholders focused on Medicaid financing, waivers and state health reform strategy.

NOTES

- Centers for Medicare and Medicaid Services, August 2018 Medicaid and CHIP Enrollment Data Highlights," www.medicaid.gov/medicaid/program-information/medicaid-and-chip-enrollment-data/report-highlights/index.html.

- Graham-Cassidy authorized adjusting block grant allotments based on a "population adjustment factor" (to account for factors such as demographics, wage rates, cost of care and other factors) beginning in 2023, but such adjustments are discretionary and not guaranteed.

- For detailed methodology, see Manatt Health, "Update: State Policy and Budget Impacts of New Graham-Cassidy Repeal and Replace Proposal," September 2017. www.manatt.com/getattachment/d02236d4-50d9-4944-b40a-bbd17328691d/attachment.aspx.

- Since Graham-Cassidy would eliminate the enhanced federal match for expansion adults, this analysis assumes that states would terminate coverage for the expansion group at the end of 2019.

- Jeanne M. Lambrew, "Making Medicaid a Block Grant Program: An Analysis of the Implications of Past Proposals," The Milbank Quarterly, 83, no. 1 (2005): 41-63. www.ncbi.nlm.nih.gov/pmc/articles/PMC2690386/pdf/milq0083-0041.pdf.

- Henry J. Kaiser Family Foundation, "Medicaid Spending by Enrollment Group," www.kff.org/medicaid/state-indicator/medicaid-spending-by-enrollment-group/.

- Henry J. Kaiser Family Foundation, "Medicaid Enrollees by Enrollment Group," www.kff.org/medicaid/state-indicator/distribution-of-medicaid-enrollees-by-enrollment-group/.

- Steve Eiken et al., Medicaid Expenditures for Long-Term Services and Supports in Fiscal Year 2016, (Medicaid Innovation Accelerator Program, May 2018), www.medicaid.gov/medicaid/ltss/downloads/reports-and-evaluations/ltssexpenditures2016.pdf.

- Medicaid and CHIP Payment and Access Commission, Report to Congress on Medicaid and CHIP, (Washington, D.C.: MACPAC, June 2017): www.macpac.gov/wp-content/uploads/2017/06/June-2017-Report-to-Congress-on-Medicaid-and-CHIP.pdf.