BICH HA PHAM, JD and DAVID ZUCKERMAN, MPP

The COVID-19 pandemic has caused dramatic job loss and business closures, disproportionately impacting lower-income groups and people of color. Communities that are financially struggling and historically disinvested have borne the brunt of the economic fallout, while funding to many local nonprofits and community groups has been cut. Despite the public health and fiscal challenges that hospitals and health systems have faced during COVID-19, these institutions have continued to invest in their communities because the health and well-being of children and families called upon them to act.

Nationally, health systems have an estimated $400 billion in investment assets.1 Redirecting even a small portion of these resources to local community investments would shift billions of dollars, allowing health care organizations to more effectively improve community health and well-being.

LEVERAGING HEALTH INSTITUTIONS' RESOURCES

Health systems are uniquely positioned as leading employers and economic engines in their communities. In adopting an anchor mission approach, these institutions leverage their resources to address the economic, racial and environmental resource disparities that impact community health outcomes, in addition to providing quality health care. Place-based impact investing, along with local inclusive hiring and local procurement, are key pillars for anchor mission implementation. Members of the Healthcare Anchor Network (HAN) intentionally use their everyday business activities — hiring, purchasing, investing — to address the disparities that affect health.

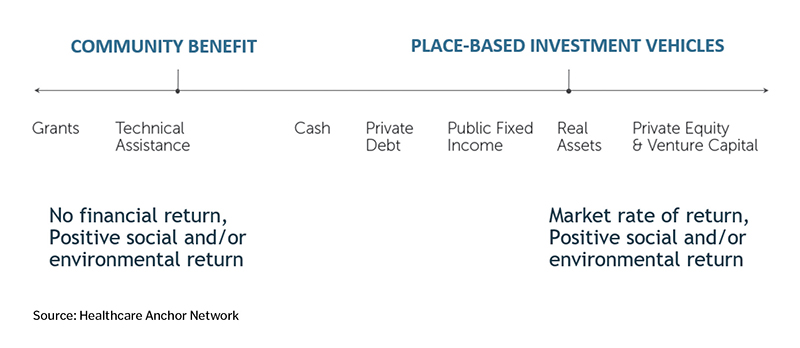

Impact investing is a key resource in the toolkit that these systems can bring to their anchor mission efforts. The goal is to create sustainable returns for the institutions while deploying investment capital to address structural determinants of health needs in their communities by targeting positive social and environmental impacts. Unlike grants, impact investing comes with an expectation of return on the investment. A common example is a health system moving a percentage of its investment portfolio allocation from public fixed-income products, such as bonds paying 2% to 3% return, to investing in the local community and obtaining a similar or slightly lower rate of return with the added benefit of positive social and/or environmental impact.

CREATING POSITIVE CHANGE

Poverty and lower household income affects health. Economic inequality is increasingly linked to disparities in life expectancy. Low-income Americans face greater barriers to accessing medical care, have higher rates of heart disease, diabetes, stroke and other chronic conditions, and have higher rates of behavioral risk factors compared to higher-income Americans.2

Place-based investing creates healthy and thriving communities by investing in disadvantaged neighborhoods and increasing the available capital for social, economic or environmental improvements. It supports diverse business development and empowers low-income people to create, manage and own enterprises. It transforms community infrastructure, services and quality of life. These investments become a revolving pool of capital that will be leveraged several times over to have an even greater impact in communities nationwide. Note that this positive social impact investing differs from "negative screens" used in socially responsible investing that filters out sectors such as tobacco for investments.

Place-based investing is distinct from grants or financial contributions in that there is an expectation of a return on the investment. However, impact investing can advance community benefit goals. For example, a health system may invest funds in a new affordable housing project as part of its community benefit strategy to address homelessness, along with its grants to homeless prevention nonprofit groups.

The benefits of place-based investing advance four meaningful organizational goals: savings in unnecessary health care expenditures; economically improved and vibrant neighborhoods; advancements in environmental sustainability, diversity and inclusion; and reliable financial returns for the investment portfolio. In essence, a business case exists for pursuing social impact investing.

Investments in affordable housing are a proven example of cost savings for hospitals. Unstable housing among families with children will cost the U.S. $111 billion in avoidable health and education expenditures over 10 years. New York City's Montefiore Health System achieved a 300% return by investing in housing for patients who are homeless, a move that has cut down on emergency room visits and unnecessary hospitalizations. The Los Angeles County's Housing for Health program saw a $1.20 savings in health care costs for every $1 invested in affordable housing for the patients.3

SOCIAL IMPACT INVESTING STRATEGIES

Hospitals and health systems can begin with fairly simple investment strategies, such as shifting deposits of cash and cash equivalents to local community banks and credit unions or by investing in low-risk fixed income products offered by community development financial institutions (CDFIs). Nonprofit CDFIs provide key financial services and resources to underserved communities. Over time, their integrated capital approach maximizes local impact by coordinating investments with grants, technical assistance and other supports. Even a 2% shift in health systems investing to CDFIs would be double the amount annually of the primary federal funding mechanisms for community development finance loans across the country.4

THE IMPACTS OF LOCAL INVESTING

Utilizing investment funds to increase the available capital for positive social, economic or environmental change has been embraced by the Catholic Impact Investing Collaborative, and many of the HAN member Catholic health systems are engaged in impact investing. Here is a brief overview of the impactful work of several Catholic health systems:

- Bon Secours Mercy Health (BSMH) has allocated 1% of the system's long-term investment portfolio, about $50 million, to place-based investments. As the system operates across multiple states, efforts are in place to ensure that these investments align with the system's geographic footprint. This is the health system's "direct community investment" strategy, supporting institutions or projects to promote access to jobs, housing, food, education and health care for low-income or minority communities. Staff from Treasury and Finance, and Community Health collaborate on this work.

Current examples of place-based investments are:

Bons Secours Mercy Health invested $900,000 with the Leviticus Fund that, at the time of the original loans, operated in the region served by three Bon Secours hospitals. The Leviticus Fund, a New York-based CDFI, used the funds to develop 14 affordable housing units for formerly homeless veterans and to partner with a land bank to develop four properties to create owner-occupied rental units.

Bon Secours Mercy Health also is set to extend loans totaling more than $2.5 million in three additional markets. Investments will support new housing developments, greater access to loans for prospective homeowners and sustainable capital pipelines for minority- and women-owned business ventures.

Some key strategies or investment vehicles Bon Secours Mercy Health uses are intermediary investments (CDFIs) and aligning community benefit with place-based investing strategies. When possible, BSMH layers grant dollars with loans.

- CommonSpirit Health's Community Investment Program has provided about $250 million over 30 years to support economic development in low-income communities. Nearly 45% of the funds are invested in affordable housing.

Dignity Health, now part of CommonSpirit Health, made direct and indirect loans to invest in projects that addressed community needs, such as affordable housing, economic development, renewable energy, arts and education, alternatives to predatory lending and health care access. About a quarter of Dignity's community investment portfolio was invested in partnership with CDFIs.5 The New York Times also wrote about Dignity's $1 million loan to La Cocina, a nonprofit that helps women of color entrepreneurs start catering and restaurant business.6

- Trinity Health's Direct Community Investment Program has allocated $75 million for social impact investments. Already, $37 million in loans have been made in 16 states, and $9 million has been committed in loans to other projects to support affordable housing, access to healthy food and access to higher education. Trinity Health works both with CDFIs and through program-related investments made directly to projects and programs in Trinity Health communities. The health system seeks projects that leverage its investment to bring on additional capital, typically sevenfold to tenfold.

Some examples of Trinity Health's recent affordable housing investments include:

A $1 million investment in Cinnaire, a CDFI serving the Midwest and Delaware, to finance the acquisition and renovation of vacant and blighted properties in distressed neighborhoods in Wilmington, Delaware.

A loan of $1 million to support the construction of Canyon Terrace, an 80-unit affordable housing development in Nampa, Idaho, targeted to families and individuals making 60% of area median income.7

- Providence has a Community Investment Fund that provides capital in the form of loans, deposits or other support to nonprofit entities to promote social good and the development of healthier communities. These loans enable community organizations that serve low-income and other vulnerable populations to play a larger role in the regeneration of their communities. Some of the programs that have received support include affordable housing, economic development and social service programs, food programs and other direct service programs, and educational and job expansion initiatives.8

Just two examples of the health system's placed-based investing efforts that totaled more than $9 million in loans include:

Providence Home and Community Care, which supports Providence Dolores House, a 16-unit, 30-bed housing project for low-income individuals with disabilities.

Jamboree Permanent Supporting Housing, where bridge funding was granted in 2019 until permanent financing was available in 2020 for the purchase and conversion of an Econo Lodge to permanent supportive housing units.9

- Ascension has committed almost $90 million to impact investing, focused on two objectives: improving access to social goods and services to the poor and vulnerable through investments in areas such as clean water, food and nutrition, adequate and affordable housing and education, health and health care, and financial services.

And environmental stewardship, giving priority to private funds that have a track record of excellent performance in environmental conservation and/or a focus on innovative green products, services or processes.

The HAN website contains several resources, including the Place-Based Investing Toolkit, to help accelerate anchor mission strategies.10 In addition, the Investing in Community Health: A Toolkit for Hospitals developed by the Catholic Health Association11 and Center for Community Investment12 provide health care organizations information and resources to maximize their impact on community health through their investment capital.

BICH HA PHAM is director, communications and policy for the Healthcare Anchor Network. DAVID ZUCKERMAN is executive director of the Healthcare Anchor Network.

NOTES

- "Place-Based Investing: Creating Sustainable Returns and Strong Communities," Democracy Collaborative, https://hospitaltoolkits.org/investment/.

- Dhruv Khullar and Dave A. Chokshi, "Health, Income, & Poverty: Where We Are & What Could Help," Health Affairs, October 4, 2018, https://www.healthaffairs.org/do/10.1377/hpb20180817.901935/full/.

- Sarah B. Hunter et al., "Evaluation of Housing for Health Permanent Supportive Housing," Rand Corporation, 2017, https://www.rand.org/pubs/research_reports/RR1694.html.

- "Place-based Investing," Health Anchor Network, https://healthcareanchor.network/2019/11/place-based-investing/.

- Pablo Bravo Vial, "Boundless Collaboration: A Philosophy for Sustainable and Stabilizing Housing Investment Strategy," Health Progress 100, no. 5 (September-October 2019), https://www.chausa.org/publications/health-progress/article/september-october-2019/boundless-collaboration-a-philosophy-for-sustainable-and-stabilizing-housing-investment-strategy?mc_cid=68a7d0b3c3&mc_eid=9f7e2e4412.

- Peter S. Goodman, "When a Steady Paycheck Is Good Medicine," The New York Times, October 10, 2019, https://www.nytimes.com/2019/10/10/business/healthcare-anchor-network.html.

- James Kienker, email to author, March 10, 2020.

- "Annual Report to Our Communities," Providence St. Joseph Health, Community Investment Fund, https://www.stjhs.org/our-programs/community-partnerships/community-investment-fund/.

- Cassie Tinari, email message to author, February 17, 2020.

- "Resources," Healthcare Anchor Network, https://healthcareanchor.network/anchor-mission-resources/.

- "Investing in Community Health: A Toolkit for Hospitals," Catholic Health Association, https://www.chausa.org/communitybenefit/social-determinants-of-health/cha-resources.

- "Investing in Community Health," Center for Community Investment, https://centerforcommunityinvestment.org/.