There is only one definition of community benefit: it is the Internal Revenue Service (IRS) definition. Other organizations, researchers and lobbyists, at times, will add or subtract categories to the way they define community benefit to fit their situation and the issues and policies they are promoting. They may also advance a false narrative that community benefit is not well defined to distract from the conversation that is needed: Ensuring that everyone has access to the affordable, high-quality health care needed to flourish.

There is only one definition of community benefit: it is the Internal Revenue Service (IRS) definition. Other organizations, researchers and lobbyists, at times, will add or subtract categories to the way they define community benefit to fit their situation and the issues and policies they are promoting. They may also advance a false narrative that community benefit is not well defined to distract from the conversation that is needed: Ensuring that everyone has access to the affordable, high-quality health care needed to flourish.

In the 1980s, CHA brought together its members to share how they were working to improve health and well-being in their communities. From the discussions, CHA published the Social Accountability Budget: A Process for Planning and Reporting Community Service in a Time of Fiscal Constraint in 1989. It provided a list of categories of community benefit, including definitions and accounting standards. Guidelines were provided on what did and did not count as community benefit.

In 2006, when Congress and the Senate Finance Committee were interested in increasing the reporting of community benefit, Sen. Chuck Grassley, R-Iowa, gave CHA's Social Accountability Budget to the IRS as guidance. The IRS, alongside CHA, the American Hospital Association (AHA), Healthcare Financial Management Association and others created Form 990 Schedule H, which became required reporting in 2008.

CHA's Social Accountability Budget is now titled A Guide for Planning & Reporting Community Benefit.1 The information and guidance in both CHA's guide and the IRS Schedule H instructions align.

COMMUNITY BENEFIT IS WELL DEFINED

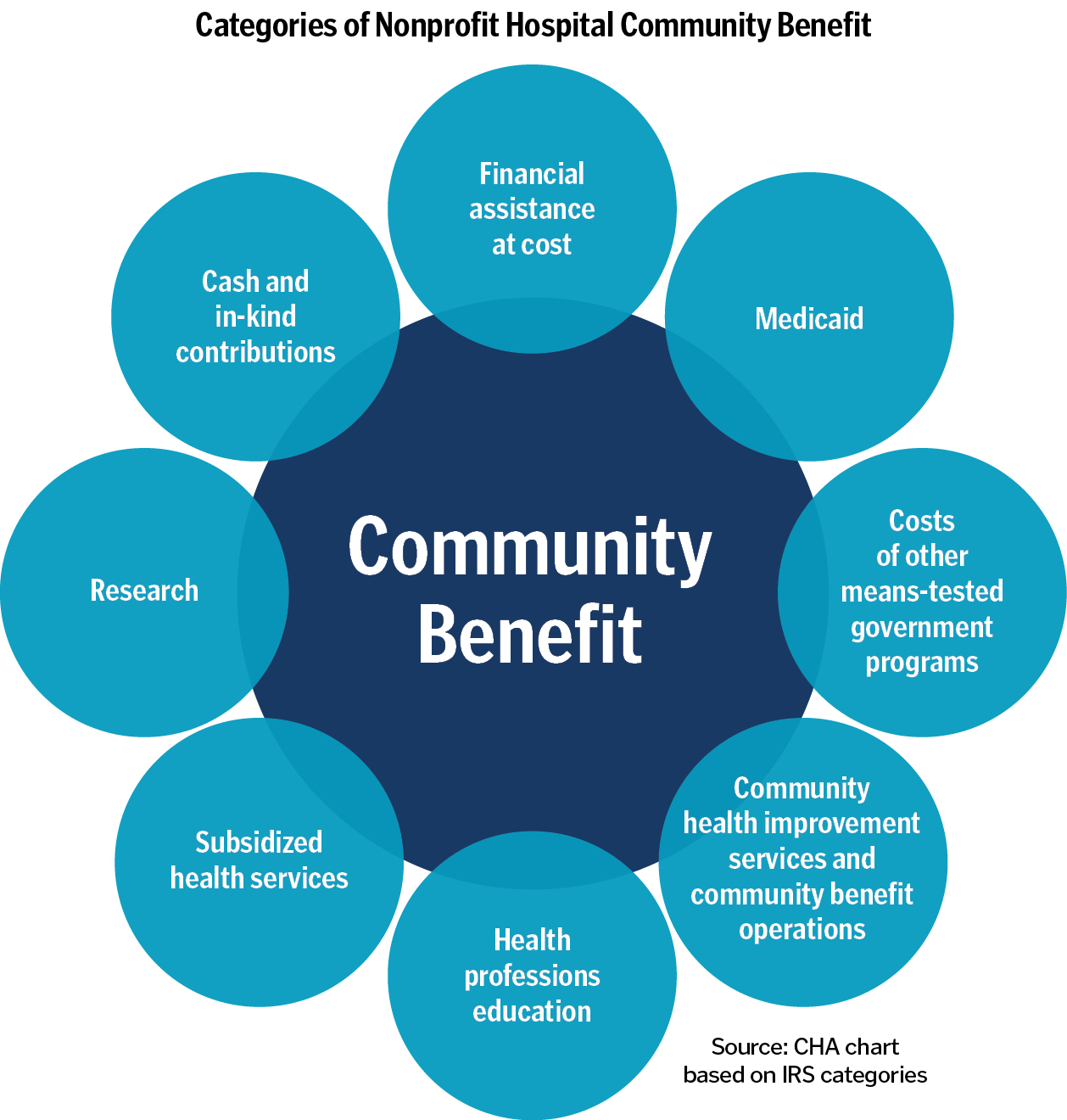

The IRS, through Form 990 Schedule H instructions, defines community benefit as activities or programs that address a demonstrated community health need and "seek to achieve a community benefit objective, including improving access to health services, enhancing public health, advancing increased general knowledge, and relief of a government burden to improve health."2 The IRS identifies eight categories of community benefit in the Schedule H, Part I, Line 7: Financial assistance at cost; Medicaid shortfall at cost; Costs of other means-tested government programs; Community health improvement services and community benefit operations; Health professions education; Subsidized health services; Research; and Cash and in-kind contributions for community benefit (see graphic on page 56).3 Additionally, to qualify as community benefit, activities must benefit the community more than the hospital organization.

A CLOSER LOOK AT COMMUNITY BENEFIT CATEGORIES

Each community benefit category improves the health and well-being of communities.4 As noted in a recent report by AHA and CHA, hospitals tailor their community benefit activities to meet the unique needs of their communities.5 All community benefit activities are reported at cost, not charges or market rates. Any offsetting revenue received from the activity and any funds received specifically in support of the activity are also reported. This results in the reported net community benefit expense.

Financial Assistance at Cost

Financial assistance at cost is commonly referred to as charity care. Financial assistance is free or discounted health care services provided to low-income individuals. The eligibility criteria are based on the hospital's financial assistance.6 Through financial assistance, many patients can access care that they might not have otherwise been able to receive.

Medicaid and Costs of Other Means-Tested Government Programs

Medicaid is the United States' health care program for low-income individuals and families. This program is means-tested with eligibility based on income and asset levels.7 Other means-tested government programs are another category of community benefit. Like Medicaid, these programs are sponsored by a government agency and are means-tested, with eligibility based on need, typically low income. The State Children's Health Insurance Program is an example of a government means-tested program.

Medicaid continues to be vital to providing access to affordable, high-quality care. Across the U.S., 41% of all births are covered by Medicaid, and 1 in 5 Americans have access to affordable health care because of Medicaid.8 Forty-nine percent of children are covered by a means-tested government program (Medicaid or Children's Health Insurance Program).9 Most hospitals' Medicaid reimbursement does not cover the cost of providing services. Yet, despite this shortfall, nonprofit hospitals, in alignment with their mission to care and commitment to their communities, persist and provide care to all regardless of ability to pay or insurance type. Medicaid and other means-tested programs increase access to health care services.

Community Health Improvement Services

Community health improvement services are activities and programs provided by the hospital to improve the health and well-being of its community.10 These programs extend beyond routine care and provide health education, clinically based services, support services, and activities that address the social and environmental factors of health. Examples of community health improvement services include mobile health units, health screenings, vaccination clinics, assistance for enrollment into government means-tested health and social service programs, transportation, violence prevention and lead abatement in housing. Also included in this category are the costs of community benefit operations, which include conducting the community health needs assessment and community benefit program administration costs.

Health Professions Education

Health professionals, during their education, are required to receive clinical training to obtain their degrees and to be certified or licensed within their state to practice. The health professions education category of community benefit reports the cost incurred by hospitals to provide this training to health professions students, including graduate medical education and training of student nurses and other allied health professionals.11 Health professions education does not include training provided exclusively to hospital staff, annual staff training or if there is a work requirement as a result of receiving this training.

Currently, there is a shortage of doctors, nurses and other health professionals, and this shortage is worsening. The National Center for Health Workforce Analysis estimates a shortage of nearly 208,000 RNs and approximately 187,000 physicians by 2037.12 Educating our future doctors, nurses and other health professionals benefits our nation and communities, building the workforce for our future health needs.

Subsidized Health Services

Subsidized health services are clinical services provided at a loss. If the hospital did not provide this service, it would be unavailable or at insufficient capacity to meet the community's care needs. In calculating the reportable community benefit, hospitals must remove the losses associated with bad debt, financial assistance, Medicaid and means-tested programs.13 Providing unprofitable services to meet community needs differentiates tax-exempt hospitals from for-profit hospitals.14 Subsidized health services increase access to needed care.

Research

Research qualifying as community benefit must aim to increase general knowledge, have its results made available to the public and only include research funded by a government or tax-exempt entity.15 Research advances knowledge and treatments of disease so that people can live longer and live well. Diagnoses that were once devastating and a life sentence are now treatable, and some are even curable, because of research. Without research, diseases flourish, and emerging diseases take hold and threaten how well and how long we live.

Cash and In-Kind Contributions

Cash and in-kind contributions are contributions made that are "restricted, in writing, to one or more of the community benefit activities" described in IRS Schedule H instructions.16 Nonprofit hospitals partner with and support community organizations to improve the health and well-being of their communities, especially organizations that are more suited to addressing priority needs and health activities.

COMMUNITY BENEFIT OVERSIGHT AND VALUE OF TAX-EXEMPTION

The IRS is the federal agency that has defined community benefit and has oversight and enforcement of community benefit, Revenue Ruling 69-545 and Internal Revenue Code (IRC) 501(r). Hospitals, through Form 990 Schedule H, annually report on compliance with the regulations. Section 9006 of IRC 501(r) requires the IRS to review nonprofit hospitals no less than every three years for compliance with the regulations.17 Additionally, Section 9007(e)(1) of the Affordable Care Act requires the IRS to annually provide Congress with a report that includes tax-exempt hospital community benefit. However, despite the clear role of the IRS, researchers are increasingly citing Medicare Cost Reports as the data used to review tax-exempt hospitals' charity care spending. This not only confuses the scope and purpose of the cost report but also effectively redefines community benefit by removing many of the community benefit categories.

Despite the clear role of the IRS, researchers are increasingly citing Medicare Cost Reports as the data used to review tax-exempt hospitals' charity care spending. This not only confuses the scope and purpose of the cost report but also effectively redefines community benefit by removing many of the community benefit categories.

Through community benefit, nonprofit hospitals not only provide an incredible benefit to their communities, but they also contribute more substantially to them than the value of tax exemption. In 2020, nonprofit hospitals provided $94 billion in community benefit in accordance with the IRS definition.18 Recently, the estimated tax benefit for nonprofit hospitals was $37.4 billion.19 When considering IRS Form 990 Schedule H, Part I, community benefit alone, nonprofit hospitals invest more than twice the benefits they receive from tax exemption in the community.

IRS Form 990 Schedule H community benefit is just one of the ways nonprofit hospitals impact the health of their communities. Nonprofit hospitals also impact the health and well-being of their communities through their primary charitable purpose of providing acute, emergent, chronic and preventive health care. Additionally, nonprofit hospitals conduct programs and make additional investments in community health and well-being that go above and beyond their primary charitable purpose and community benefit, including investments in housing and economic development, along with purchasing strategies. When looking at the full picture and considering all the ways nonprofit hospitals impact the health and well-being of their communities, it is clear that nonprofit hospitals are a key asset to our health and well-being.

BUILDING HEALTHIER COMMUNITIES

Nonprofit hospital community benefit is well defined by the IRS. The IRS also has oversight and enforcement over community benefit. All eight categories of IRS Form 990 Schedule H community benefit are important to the health and well-being of our communities.

Nonprofit hospitals are a cornerstone of their communities' health and well-being. They tailor their community benefit activities to respond to their communities' unique needs. Nonprofit hospitals' investments in community health and well-being far exceed the value of their tax exemption.

NANCY ZUECH LIM, MPH, BSN, is director of community health improvement for the Catholic Health Association, Washington, D.C.

NOTES- "A Guide for Planning and Reporting Community Benefit," Catholic Health Association, https://www.chausa.org/communitybenefit/a-guide-for-planning-and-reporting-community-benefit.

- "2024 Instructions for Schedule H (Form 990)," Internal Revenue Service, https://www.irs.gov/pub/irs-pdf/i990sh.pdf.

- "Schedule H (Form 990)," Internal Revenue Service, https://www.irs.gov/pub/irs-pdf/f990sh.pdf.

- "Community Benefit Categories Quick Reference Guide," Catholic Health Association, https://www.chausa.org/focus-areas/community-benefit/resources/resource/community-benefit-categories-quick-reference-guide.

- "Nonprofit Hospital Community Benefits: Addressing Each Community's Unique Needs," American Hospital Association, https://www.aha.org/nonprofit-hospital-community-benefits-addressing-each-communitys-unique-needs.

- The IRS definition of financial assistance at cost: "Financial assistance includes free or discounted health services provided to persons who meet the organization's criteria for financial assistance and are unable to pay for all or a portion of the services."

- The IRS definition of Medicaid is, "… the United States health program for individuals and families with low incomes and resources." "Other means-tested government programs" are defined as "government-sponsored health programs where eligibility for benefits or coverage is determined by income or assets."

- Alice Burns, Elizabeth Hinton, Robin Rudowitz, and Maiss Mohamed, "10 Things to Know About Medicaid," KFF, February 18, 2025, https://www.kff.org/medicaid/issue-brief/10-things-to-know-about-medicaid/.

- "AAP Analysis: 49% of Children Insured by Medicaid or CHIP," AAP, February 27, 2025, https://publications.aap.org/aapnews/news/31491/AAP-analysis-49-of-children-insured-by-Medicaid-or.

- The IRS definition of community health improvement services is "activities or programs, subsidized by the health care organization, carried out or supported for the express purpose of improving community health. Such services don't generate inpatient or outpatient revenue, although there may be a nominal patient fee or sliding scale fee for these services." The IRS definition of community benefit operations is "activities associated with conducting community health needs assessments, community benefit program administration, and the organization's activities associated with fundraising or grant writing for community benefit programs."

- IRS Schedule H defines health professions education as "educational programs that result in a degree, a certificate, or training necessary to be licensed to practice as a health professional, as required by state law, or continuing education necessary to retain state license or certification by a board in the individual's health profession specialty. It doesn't include education or training programs available exclusively to the organization's employees and medical staff or scholarships provided to those individuals."

- "Nurse Workforce Projections, 2022-2037," HRSA, November 2024, https://bhw.hrsa.gov/sites/default/files/bureau-health-workforce/data-research/nursing-projections-factsheet.pdf; "Physician Workforce: Projections, 2022-2037," HRSA, November 2024, https://bhw.hrsa.gov/sites/default/files/bureau-health-workforce/data-research/physicians-projections-factsheet.pdf; "Health Workforce Projections," HRSA, November 2024, https://bhw.hrsa.gov/data-research/projecting-health-workforce-supply-demand.

- IRS Schedule H defines subsidized health services as "clinical services provided despite a financial loss to the organization. The financial loss is measured after removing losses associated with bad debt, financial assistance, Medicaid, and other means-tested government programs. In addition, in order to qualify as a subsidized health service, the organization must provide the service because it meets an identified community need. A service meets an identified community need if it is reasonable to conclude that if the organization no longer offered the service:

- The service would be unavailable in the community,

- The community's capacity to provide the service would be below the community's need, or

- The service would become the responsibility of government or another tax-exempt organization."

- Jill R. Horwitz and Austin Nichols, "Hospital Service Offerings Still Differ Substantially by Ownership Type," Health Affairs 41, no. 3 (2022): https://doi.org/10.1377/hlthaff.2021.01115.

- IRS Schedule H defines research as any "study or investigation the goal of which is to generate increased generalizable knowledge made available to the public. The organization cannot include in Part I, line 7h, direct or indirect costs of research funded by an individual or an organization that isn't a tax-exempt or government entity."

- IRS Schedule H defines cash and in-kind contributions as "contributions made by the organization to health care organizations and other community groups restricted, in writing, to one or more of the community benefit activities described in the table in Part I, line 7."

- "Legal Requirements for Section 501(c)(3) Hospitals," Congress.gov., https://www.congress.gov/crs-product/R48027.

- "Estimates of the Value of Federal Tax Exemption and Community Benefits Provided by Nonprofit Hospitals, 2020," American Hospital Association, https://www.aha.org/2024-09-23-estimates-value-federal-tax-exemption-and-community-benefits-provided-nonprofit-hospitals-2020.

- Elizabeth Plummer, Mariana P. Socal, and Ge Bai, "Estimation of Tax Benefit of U.S. Nonprofit Hospitals," JAMA 332, no. 20 (2024): https://doi.org/10.1001/jama.2024.13413.