BY: TIMOTHY J. ECKELS, M.C.P.

Mr. Eckels is vice president for public policy, Trinity Health, Novi, Mich.

Timothy Eckels was a consultant with the Lewin Group in 1989, and one of the original authors of the first CHA guidebook on community benefit.

Next year will mark the 20th anniversary of the CHA guidebook on community benefit. Developed under the leadership of a CHA member workgroup chaired by Sr. Bernice Coreil, DC, the document was called Social Accountability Budget: A Process for Planning and Reporting Community Service in a Time of Fiscal Constraint. The guidebook, the first effort of its kind to articulate more precisely what was meant by community benefit, was designed to:

- help reinforce the Catholic health care tradition of serving the poor and disadvantaged by making community benefit an integral part of hospital planning.

- demonstrate accountability at a time when (like today) policymakers were challenging the tax-exempt status of hospitals.

- strengthen the ministry's credibility as an advocate for compassionate and just public policies.

The original document was also designed to move the tax exemption debate of the day beyond a narrow preoccupation with charity care (or uncompensated care) as the only measure of community benefit. The guidebook defined a wide array of commitments to the community, many of which entailed relatively low cost while producing substantial returns to the health and well-being of patients and families.

However, as this article will reveal, the emphasis on numbers through the years poses some concerns. Also, with the implementation of the new IRS Form 990, questions persist about reporting proactive leadership efforts.

An Unintended Tendency to Emphasize Numbers

The CHA workgroup was pleased by how quickly many Catholic organizations began using the guidebook in the years after publication. Workgroup members were dismayed, however, by a tendency of hospital leaders to emphasize the counting and reporting of existing activities that could be quantified while sidestepping the call for integrated planning of community benefits. Hospital leaders also underreported a series of proactive leadership activities more difficult to associate with a dollar value.

Specifically, the original document defined two categories of community benefit. Category 1 was called "services for the poor and broader community," including such countable activities as traditional charity care, unpaid cost of Medicaid, research, health professional training and other "nonbilled" services. Category 2 was called the "leadership and facilitating role of the not-for-profit institution," included a series of specific activities under seven topics:

- responsiveness to the community and needs of the poor

- leadership in identifying needs

- advocacy and promotion of community-wide efforts for the poor

- serving as a vehicle for attracting and effectively using donated funds

- offering opportunities for and encouraging volunteer efforts

- preservation of resources within the community health care system

- promotion of equity and justice in public policies

While refined in subsequent CHA guidebooks, the definitions under Category 1 remain today as the primary focus of community benefit reporting. CHA has continued to emphasize various versions of Category 2 — as well as the need for more proactive, integrated planning — but human nature being what it is, many health care organizations often still focus passively and retrospectively on "what can be counted."

Unfortunately, policy makers often fall into the same trap. Proposals for greater accountability focus almost exclusively on numerical thresholds. Last year, for example, minority staff of the Senate Finance Committee issued a white paper calling for a requirement that tax-exempt hospitals devote at least 5 percent of their expenses to charity care and a narrow group of other community benefits.

Adverse Consequences of Numerical Thresholds

Why is this exclusive emphasis on countable activities a problem? In part, the answer can be found in the core IRS requirement that tax-exempt hospitals be engaged in the "promotion of health" and provide community benefits, including the use of surplus funds to improve health care. Similarly, the answer can be found in many mission statements of Catholic organizations, which often include a reference to "improving community health." Fulfilling this mission requires leadership, strategic planning and innovation that reaches far beyond hospital walls and entails a much richer set of activities than passively providing traditional charity care or counting up the cost of existing programs.1

This richer set of activities, while hard to quantify, is key to the "promotion of health." Neither the mission nor the tax-exempt purpose of a hospital should ever be boiled down to a number.

Table 1 illustrates the point. Assume that Congress imposes a 5 percent tax-exemption threshold for charity care and certain other quantifiable community benefits. Hospital A responds by publicizing its charity care policy, prompting enough additional emergency department visits and admissions by uninsured patients to reach the threshold. Hospital B responds by taking an aggressive leadership role in the community, forming a multi-organizational innovation that improves the health of the uninsured, leverages new resources in the community, generates new philanthropic spending and stimulates a cadre of volunteer physicians and nurses.

Ironically, Hospital B loses its tax exemption because the innovation succeeds in reducing emergency department visits and avoidable hospitalizations by the uninsured. Furthermore, even though both hospitals spent the same percentage of new funds in their attempt to reach the new threshold, Hospital B pursued a more strategic approach to the "promotion of health," thereby generating a much richer set of impacts for the community. This "unintended effect" is one of the many reasons why simple numerical requirements are misdirected and counterproductive. This is also why health care organizations should never limit their planning and their reporting to the counting of dollars.

An Opportunity for More Integrated Reporting: Form 990

The new IRS Form 990, while focused primarily on community benefit spending levels, allows for the reporting of these proactive leadership efforts. Thanks to CHA's intense advocacy work on this issue, the new Schedule H includes the following instruction under Part VI:

Provide any other information important to describing how the organization's hospitals or other health care facilities further its exempt purpose by promoting the health of the community (e.g., open medical staff, community board, use of surplus funds, etc.)

A robust response to this item is critical. To date, the IRS has agreed with the argument that its "community benefit standard" for tax exemption does not need to be overlaid with a one-size-fits-all spending threshold. But the temptation for policymakers to keep pushing for this simplistic approach will only increase as they begin to see and compare community benefit numbers from the new 990. Catholic health care needs to ensure that these lawmakers — as well as our communities — understand not just what we are spending, but also understand how we are spending it, and with what impact on the health of our communities. They also need to see that our efforts reach far beyond a simple tally of dollars spent or numbers served.

Catholic health care's response to Part VI should include a comprehensive description of how an organization:

- is organized to promote the health of the community. Reiterate the mission and purpose of the organization and stress that it is organized to identify and respond to community needs. Indicate that the mission is executed under the authority of a board that includes community representatives and processes for determining and responding to health needs. Point out that surplus funds are reinvested into the health of the community rather than being distributed to shareholders. Include a reference to the organization's commitment to serve everyone, regardless of ability to pay.

- responds to the needs of the community, including (but not limited to) the health care needs of the uninsured, the poor and other disadvantaged populations. Include the organization's role in identifying needs and in developing new programs to specifically address those needs. Stress any community-wide, collaborative efforts in which the health care organization played a leadership role, even if few direct expenses were incurred. Highlight any efforts designed to reduce disparities or inequities in care. Also, cite specific services or any sole provider organizations (e.g., small rural hospitals within a system) that generate low or negative margins, but that are supported by the larger organization to meet community need.

- partners with other organizations to identify needs, strengthen existing community programs and provide needed services. Indicate how these partnerships leverage the strengths of multiple organizations while encouraging collaboration on other issues.

- demonstrates an impact on the health of the community. Provide an integrated overview of the community benefits enumerated in earlier sections, describing the organization's vision for community health and showing how the various activities are aimed at specific outcomes (e.g., enhanced access to care, coordination of care, prevention, wellness, improved outcomes for chronic conditions, fewer low-birth-weight babies, etc.). When possible, cite outcome statistics that demonstrate how the initiatives are improving or promoting health. Point out that some programs may entail relatively low cost (such as prenatal education programs), but generate substantial benefits to the community (such as the improved health and lower costs associated with a reduction in low-weight births).

- leverages additional community and/or external resources by taking a leadership role on new initiatives. Cite the "ripple effect" that occurs when other organizations contribute new resources to a collaborative initiative, including new volunteers.

- leads efforts to improve the quality, safety and efficiency of health care for patients and communities. Reiterate the overall point that excess revenues generated by the tax-exempt organization are reinvested into better facilities and better health care for the community. When the organization has played a "lead innovator" role with quality or information technology initiatives, for example, cite these as mission-driven efforts that are aimed at better health care. This is in contrast to organizations that wait until new technologies or quality initiatives are developed by others so that they can preserve short-term profits while benefiting from the up-front exploratory investments that are often made by not-for-profit organizations. Similarly, efforts to make health care more efficient should be highlighted, especially if the organization can demonstrate that it is a comparatively low-cost, high-quality provider.

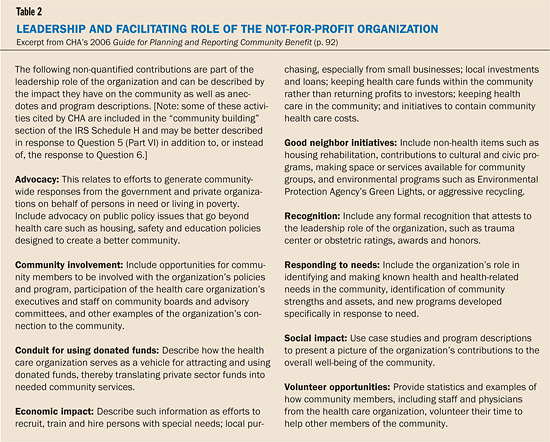

- plays a leadership and facilitating role for the community by engaging in the range of additional activities outlined by CHA in the "Leadership Journaling" section of the 2006 Guide for Planning and Reporting Community Benefit in Table 2.

Lessons for the Future

What have we learned during the 20 years since CHA first suggested a systematic process for planning and reporting community benefits? The effort was certainly successful in meeting one goal, which was to move the debate about not-for-profit hospitals beyond a narrow focus on traditional charity care to a broader set of hospital activities and spending. This is evident in the relatively comprehensive numerical approach taken by the IRS in revising Form 990.

It would be ironic, however, if the 20-year effort succeeded only in replacing one number with another as the primary focus of debate. When hospital leaders or lawmakers describe community benefit in purely numerical terms, they are diminishing the much broader and infinitely more valuable purpose of tax-exempt hospitals. A full description of community benefit needs to paint a richer and more meaningful picture of mission by including the leadership and facilitating role of the organization and the impact it is having on the health of the community.

A health care organization that plans and pursues community benefit within this broader context is not only demonstrating fidelity to mission, but also demonstrating why tax exemption remains a solid public policy worth preserving.

Author's note: I wish to express my appreciation to Natalie Dean, Lisa Gilden, David Seay and Julie Trocchio for their thoughtful comments on this article, and to William J. Cox for his leadership during development of the original community benefit guidebook.

NOTE

- J. David Seay, "Beyond Charity Care: Mission Matters for Tax-Exempt Health," Catholic Health Association, 2007, www.communityhlth.org/communityhlth/files/files_resource/Community%20Benefit/4178%20CHA_monograph.pdf.

Copyright © 2008 by the Catholic Health Association of the United States.

For reprint permission, contact Betty Crosby or call (314) 253-3477.