BY: JASON NIEHAUS, L.N.H.A., M.B.A.

Guided by our sponsors' centuries-old example, Catholic Health Partners (CHP) focuses on strengthening our shared ministry by continually assessing and adjusting our efforts to meet the needs of the day in an ever-changing world. We are called to serve by welcoming new opportunities to enhance how we bring our sponsors' vision to life.

The importance of senior services and the increasing need for that ministry as the U.S. population ages made the continuum of care part of a major strategic imperative. CHP's senior health and housing facilities historically have been managed independently within the three CHP regions that owned facilities. The facilities showed significant diversity in service offerings, reflecting differences in market needs, regional priorities and the fact that a portion of the facilities were obtained through mergers or affiliations.

In May 2010, CHP consolidated all long-term care operations into a separate service line, a move reflecting senior leadership's consensus that long-term care was not receiving the same resources, focus and attention as CHP's hospital operations. A single management team took charge of the combined operations with the following intended outcomes:

- Ensure the continuation of CHP's Catholic presence in the long-term care ministry

- Facilitate transfer of best practices among the facilities

- Strengthen and ensure the viability of long-term care operations for the long term

- Enhance collaboration in furtherance of a unified and focused mission

- Ensure that the long-term care facilities receive an appropriate share of capital investment

- Reduce costs through economies of scale

- Centralize and focus management and oversight and develop (through the new senior health and housing services division president) a long-term care "champion" within the CHP system

As a separate service line, CHP's senior health and housing service enhanced its focus and reporting capabilities and established industry benchmarks and internal targets to measure quality, improve safety and efficiency through an engaged workforce. The division engaged content experts to focus on strategic and capital needs on a facility-by-facility basis. This focus contributed to improved outcomes for the residents' environment and a vision for how CHP should respond to this sector of the health care delivery model.

Still, we face challenging internal factors — significant capital needs, coverage gaps within CHP regions and facilities located outside of our acute-care markets — along with our industry's operating environment of declining occupancy rates, state Medicaid budget cuts and cuts in Medicare reimbursement for skilled nursing facilities.

CHP identified three critical factors that affect our future growth — market position, capital constraints and reimbursement. We believe there is a need for the services we provide, but the change in consumer demands has greatly inhibited our market position. Consumer demand has shifted away from the "commingled" service model in which residents requiring various levels of care share facilities and services. Providers must be distinct in their medical model or residential model.

Location is a critical factor to integrated delivery of care, and, for patients, many studies suggest location and proximity to family and home are among the most important aspects in making a decision where to receive care. In CHP's Cincinnati region, many senior health and housing facilities fall outside of CHP hospitals' primary and secondary markets. Meanwhile, competitors have established facilities within less than a mile of the acute sites. There also are several CHP regions that do not contain any CHP-owned senior housing facilities. Determining how to bridge these coverage gaps was an important strategic imperative.

In the senior health and housing services, success is increasingly based on size despite limited future growth in payment schedules and reimbursements. Cuts from Medicare and Medicaid contribute to marginal returns that make it increasingly difficult to make the level of capital investments necessary to respond to the shifts in consumer demands.

Taking market factors into consideration, along with the fact that many of our physical facilities are in working order but are showing their age, CHP leadership began to zero in on the capital commitment necessary to reposition facilities in particular markets, update the current service model and update physical facilities with consumer-driven amenities. They also needed to plan on a long-term annual capital commitment to subsidize the capital capacity of the service line as a result of low operating margins.

The facilities in which we deliver care to our elders are sacred places. Many of those for whom we care have left the familiar setting of their own homes to make a new home with us. They now depend on us to assist them with things they have always done for themselves.1 It is important that those for whom we care and their friends and families, as well as our caregivers and staff, experience a welcoming, attractive, comfortable and safe environment.2

Since its creation, the senior health and housing service line has gained top scores in resident satisfaction, achieved a 12 percent improvement in Centers for Medicare and Medicaid Services (CMS) quality measures and reduced harm from falls with injury, among other achievements. A lift program implemented across the service line has improved resident safety and reduced lost time due to caregivers' work-related injury, and by partnering with a therapy management company for rehab services, the division is showing improved patient outcomes and operating metrics.

However, we believe we can make a broader and more immediate impact through influencing the coordination and quality of care within each of our acute-care markets, regardless of whether the facilities are owned or operated in partnership with other quality providers.

To test this belief, the Senior TEA (transparency, efficiency and accessibility) Care conceptual model was developed by CHP's senior health and housing services division and is now in the process of a pilot project in CHP's Toledo market. TEA puts together an integrated network of preferred providers dedicated to improving the health of seniors in the communities we serve. The providers don't have to be owned by CHP — they gain "preferred" status via a scorecard established from criteria CMS uses in its value-based demonstration project.

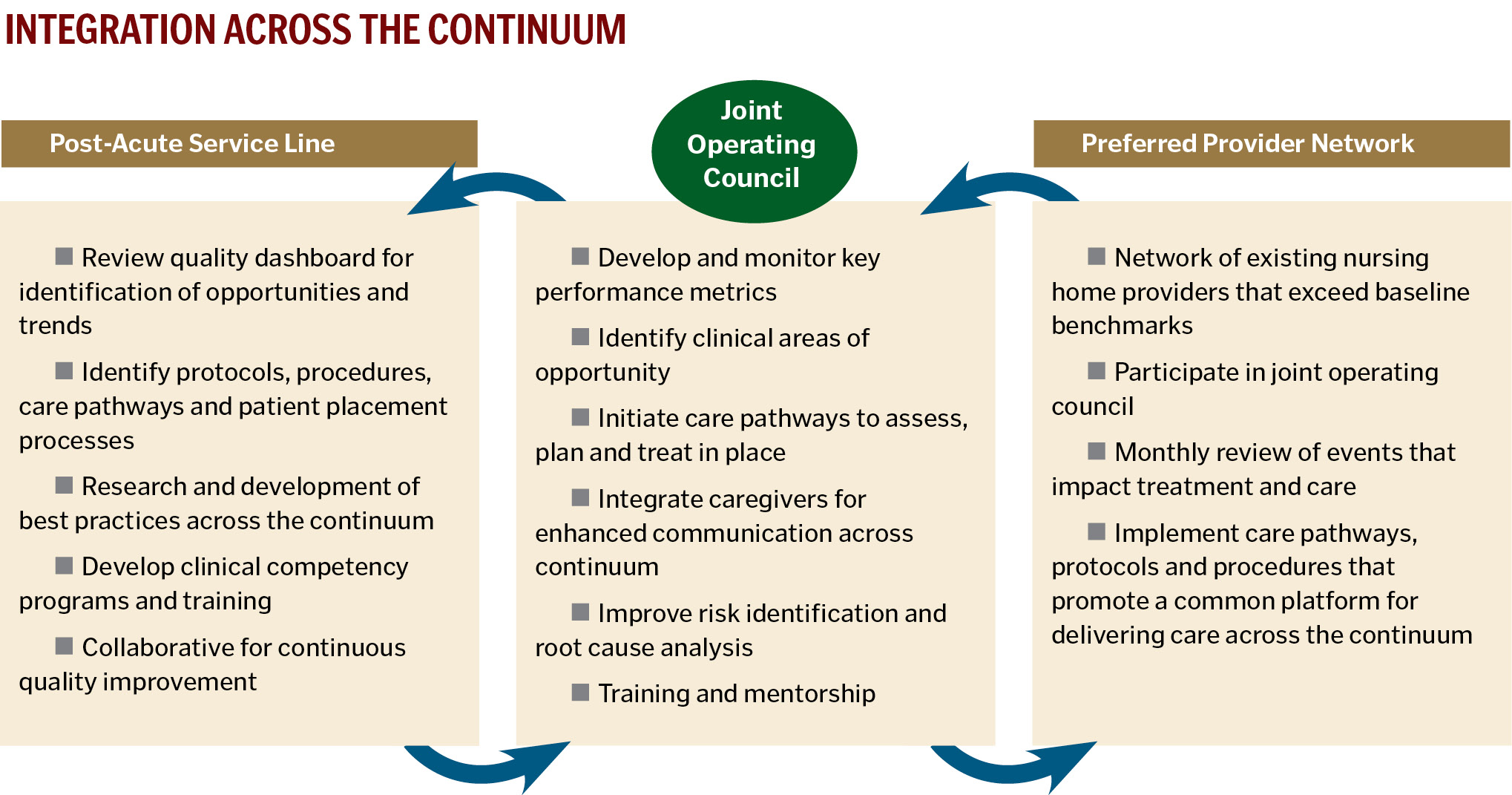

The eventual goal is to roll out the TEA model across the CHP system; that is, to identify preferred providers in each CHP acute-care market and integrate services across the continuum through collaboration between the preferred providers and the acute-care sites. This process will be identified as a "joint operating council."

While our mission will never change — "to extend the healing ministry of Jesus by improving the health of our communities with emphasis on people who are poor and underserved" — the manner by which we fulfill this mission must adapt from time to time to address the new reality in a changing environment. At the heart of many critical industry factors is the fact that health care providers in America are not financially or clinically integrated to coordinate patient care. Our health care structure and reimbursement system simply do not reward the provision of high quality, well-coordinated, efficient care.

We could wait to see what approach health care reform takes before implementing wholesale change, but our mission requires more of us. If we are to continue Jesus' healing ministry with an emphasis on the poor and underserved, we must develop a new health care delivery model, and we can succeed in this endeavor by integrating our services across the care continuum.

JASON NIEHAUS is president of senior health and housing services for Catholic Health Partners, Cincinnati.

NOTES

- Catholic Health Association, "Catholic Eldercare: A Life-Giving Experience" (2010): 12.

- "Catholic Eldercare," 7.

- Catholic Health Partners, "Centuries of Service, Vibrant Future," (2011): 9.

CATHOLIC HEALTH PARTNERS

CHP is based in Cincinnati and is made up of seven regional health systems in Ohio and Kentucky. Among them is a substantial long-term care portfolio of 15 facilities offering skilled nursing, assisted living and independent living. They comprise more than 2,000 beds providing more than 800,000 patient days on an annual basis.

TEA SCORECARD

The TEA scorecard helps identify providers that are performing at or better than benchmark in key nursing home performance-based measures:

- Nurse staffing

- Rates of potentially avoidable hospitalizations

- CMS quality measures

- Results from state survey inspections

- Family/resident satisfaction

CHP'S CONTINUUM OF CARE GOALS

- Better align and coordinate post-acute care with our regions' delivery systems

- Support acute-care delivery by accepting difficult referrals, reducing acute length of stay, managing readmissions

- Bridge the gap across the care continuum within each of CHP's acute markets

- Introduce standard scorecard measures to identify prospective partners for senior services to achieve high quality, well-coordinated and efficient care as a part of the continuum

Copyright © 2012 by the Catholic Health Association of the United States

For reprint permission, contact Betty Crosby or call (314) 253-3477.